Accounting for Small Business

Accounting for Small Business – Trying to run a small business without understanding its finances is like flying a plane with no instruments. You might stay in the air for a while, but you’re really just guessing your way forward with no idea where you’ll land. This guide is your practical accounting for small business course, designed to put you firmly in the pilot’s seat.

Why Financial Literacy Is Your Greatest Business Asset

Getting to grips with basic accounting isn’t just about getting your taxes right once a year. It’s about making smarter, data-backed decisions every single day. When you know your numbers, you can spot growth opportunities with confidence, sidestep common cash flow traps, and build a business that’s truly built to last.

This roadmap is designed to turn complex financial ideas into real-world skills you can use straight away. The goal is simple: to take you from a place of financial guesswork to total confidence in your business’s future.

The Foundation for Smart Decisions

Every good business decision—from hiring your first employee to launching a new marketing campaign—is built on a solid understanding of the numbers. Without it, you’re just winging it.

Financial literacy is the bedrock of strategic growth. It transforms reactive problem-solving into proactive decision-making, giving you the power to anticipate challenges and seize opportunities before they arise.

Knowing your numbers means you can answer the tough questions with certainty. For example, by reviewing your Profit & Loss statement, you might discover that a specific product has a much higher profit margin than others. Actionable insight: you can now double down on marketing that product. Or, a quick glance at your cash flow forecast might show a tight month coming up. Actionable insight: you can proactively arrange a short-term overdraft or delay a non-essential purchase. This knowledge is the difference between surviving and thriving.

Navigating a Competitive UK Market

The UK business scene is fast-paced and fiercely competitive. Small and medium-sized enterprises (SMEs) are the lifeblood of the economy, making up over 99% of all businesses. With roughly 5.5 million private sector businesses out there, a great idea isn’t enough; you need sharp financial management to stand out. You can find more UK business stats over at money.co.uk. This is where an accounting for small business course becomes an invaluable tool.

In this kind of environment, there’s very little room for error. A solid grasp of accounting helps you:

- Secure Funding: Lenders and investors won’t even talk to you without seeing organised, accurate financial records. They’ll want to see your balance sheet, profit and loss statements, and cash flow projections to feel confident in your business’s viability.

- Manage Cash Flow: Poor cash flow is one of the biggest reasons small businesses fail. Understanding what’s coming in and what’s going out is absolutely critical. For example, knowing your average ‘debtor days’ (how long it takes customers to pay you) helps you forecast your cash reserves accurately.

- Ensure Compliance: Staying on the right side of HMRC prevents eye-watering penalties and legal headaches down the road. This means knowing your deadlines for VAT returns, Corporation Tax, and Self Assessment.

Ultimately, financial literacy gives you the power to build a sustainable business from the ground up, even if you’re on a tight budget. In fact, it’s a key part of our guide on how to start a business on a budget. By taking control of your financial education, you are investing directly in your company’s long-term success and resilience.

Understanding the Language of Your Business

Every business tells a story through its numbers. It’s easy to get lost in spreadsheets and software, but at its core, accounting is simply the language your business uses to talk to you. It tells you where you’ve been, where you are now, and where you might be heading. This section is your first lesson in becoming fluent.

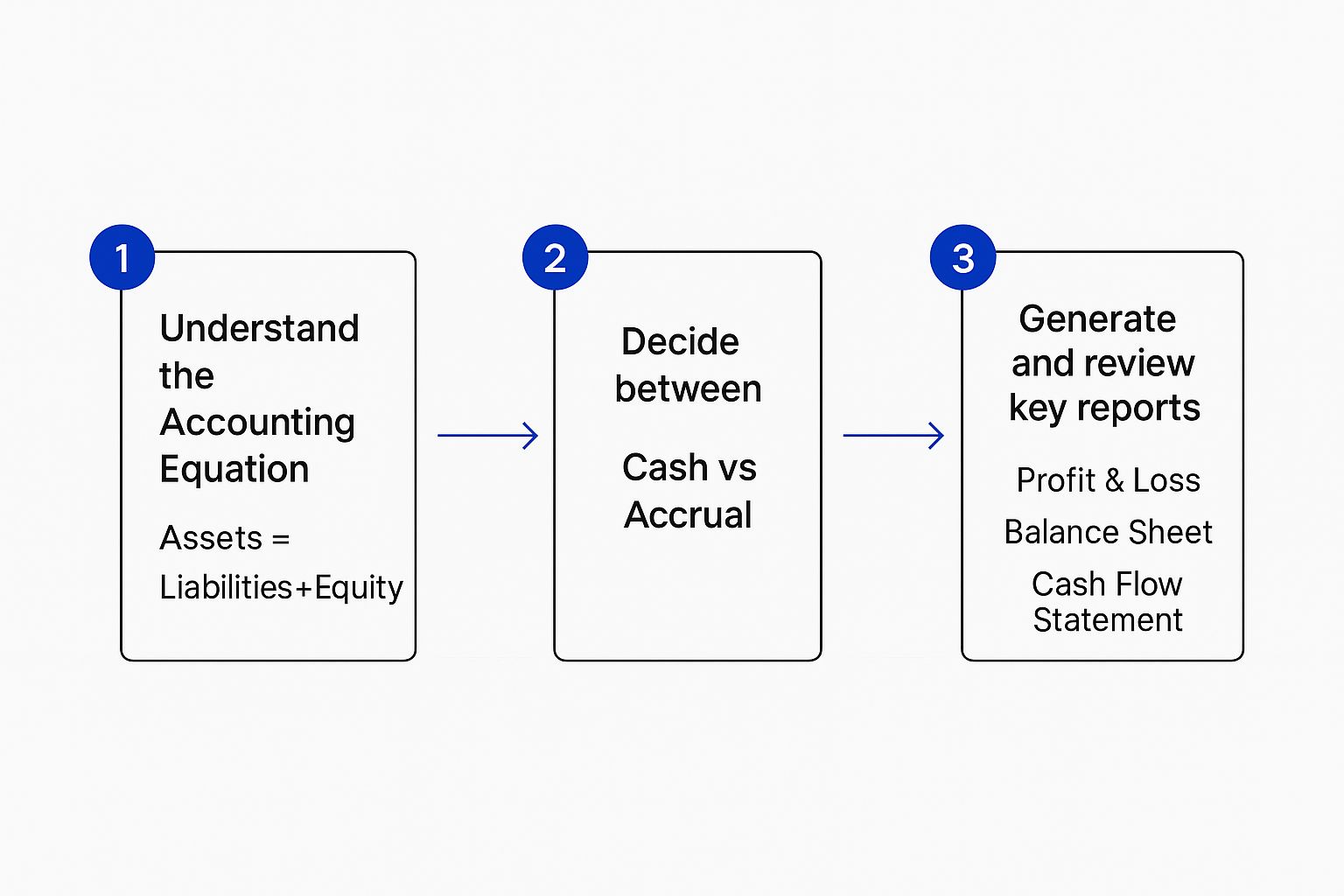

We’ll walk through the fundamental steps to building your financial understanding, moving from core principles to the actionable reports you’ll use every day.

This roadmap shows you exactly how the foundational concepts lead directly to the reports you’ll use to make smart, strategic decisions.

The Accounting Equation: Your Business’s Grammar

At the heart of every transaction and report is one simple, powerful formula: the accounting equation. Think of it as the foundational grammar for this new language you’re learning.

Assets = Liabilities + Equity

Let’s break that down into plain English.

- Assets are all the valuable things your business owns. This includes cash in the bank, your equipment, stock, and even money owed to you by customers (known as ‘accounts receivable’).

- Liabilities are what your business owes to others. This could be a bank loan, credit card debt, or invoices from your suppliers (known as ‘accounts payable’).

- Equity is what’s left over for you, the owner. It’s the value of your assets after all your debts are paid off.

Imagine you’re starting a small coffee shop. You buy a professional espresso machine for £5,000. To do this, you use £2,000 of your own savings (Equity) and take out a small business loan for the remaining £3,000 (Liability).

Your equation would look like this:

£5,000 (Asset) = £3,000 (Liability) + £2,000 (Equity)

This equation must always balance. It provides a constant, reliable snapshot of your business’s financial position at any given moment.

Cash vs. Accrual: Two Different Ways to Tell Time

Next up, you need to decide when to record your financial transactions. There are two main methods for this, and choosing the right one is a critical early step.

- Cash Accounting: This is the simple one. You record income when cash actually lands in your bank account and expenses when cash actually leaves it. It’s straightforward and gives you a clear view of your immediate cash position.

- Accrual Accounting: This method is a bit more sophisticated. It records income when it’s earned and expenses when they’re incurred, regardless of when the money actually changes hands. This gives you a much more accurate picture of your profitability over a specific period.

Let’s say you’re a freelance graphic designer. You complete a project in March and send an invoice for £1,000. The client doesn’t pay you until April.

With cash accounting, you’d record that £1,000 of income in April, when the money arrived. But with accrual accounting, you’d record it in March—the month you actually did the work and earned it. For most small businesses, especially limited companies, accrual accounting is the required standard because it provides a truer financial view.

The accrual method tells the story of your profitability, showing the results of your business activities in a period. The cash method tells the story of your survival, showing if you have the cash to operate right now.

Your Three Most Important Financial Reports

Once you have your system in place, you can generate the three key financial statements. These aren’t just boring documents; they are your business’s vital dashboards, telling you everything you need to know about its health.

- The Profit & Loss (P&L) Statement: Also known as the Income Statement, this report shows your revenues and expenses over a period (like a month or a quarter). It answers the big question: “Are we actually making a profit?”

- The Balance Sheet: This statement provides a snapshot of your business on a single day. It lays out what you own (Assets) and what you owe (Liabilities), with the difference being your Equity. It answers the question: “What is our net worth?”

- The Cash Flow Statement: This report tracks the actual movement of cash in and out of your business from operations, investing, and financing. It answers the crucial question: “Where did our cash go?”

Getting comfortable with these three reports is the end goal. They work together to give you a complete, 360-degree view of your business, empowering you to make informed, strategic decisions instead of just guessing your way forward.

Building Your Financial Control Centre

With the core concepts under your belt, it’s time to shift from theory to practice. This is where you build your business’s financial nerve centre—a reliable accounting system that turns a pile of receipts and invoices into genuine, actionable intelligence.

Your very first decision is a big one: choosing your primary tool. Will you start with familiar spreadsheets, or is it time to invest in dedicated accounting software? The right answer really depends on your business’s complexity, budget, and where you plan to be in a year or two.

Spreadsheets vs Accounting Software

For a brand-new sole trader with just a handful of transactions each month, a well-organised spreadsheet can feel like enough to get started. It’s cheap and you probably already know how to use it. The problem is, as soon as your business starts to grow, this manual approach becomes a huge time drain and a magnet for human error. A single misplaced decimal point can cause a world of trouble.

On the other hand, accounting software is built from the ground up for this very job. Tools like Xero, QuickBooks, and FreeAgent automate the boring stuff, slash the risk of errors, and give you a real-time snapshot of your financial health. Many even link directly to your business bank account, pulling in transactions automatically.

Let’s put the two approaches head-to-head.

Choosing Your Accounting System: Spreadsheet vs Software

While a simple spreadsheet might seem like the easy option for a new business, accounting software is specifically designed to handle the complexities of business finance, saving you time and preventing costly mistakes.

| Feature | Spreadsheets (e.g., Excel) | Accounting Software (e.g., Xero, QuickBooks) |

|---|---|---|

| Cost | Low initial cost (often free with existing software suites). | Monthly subscription fee, typically starting around £10–£30. |

| Automation | Entirely manual data entry for every single transaction. | Automates transaction imports, invoicing, and report generation. |

| Accuracy | High risk of human error from typos or formula mistakes. | Significantly lower error risk due to built-in calculations. |

| Reporting | Requires manual creation of financial reports, which is complex. | Generates professional P&L, Balance Sheets, and Cash Flow Statements instantly. |

| Scalability | Becomes very difficult to manage as transaction volume increases. | Easily scales with your business, handling thousands of transactions. |

| Compliance | Does not automatically handle compliance like Making Tax Digital (MTD) for VAT. | Designed to be MTD compliant, simplifying VAT submissions to HMRC. |

Although the low initial cost of a spreadsheet is tempting, the value packed into modern accounting software is enormous. In fact, a recent study found that 73% of accountants believe their clients who use cloud accounting software are more successful. It’s a fundamental part of any modern accounting for small business course for a reason.

Setting Up Your Chart of Accounts

Once you’ve picked your tool, the next step is to create your Chart of Accounts. This sounds a bit technical, but it’s really just a list of all the financial categories your business uses to sort its transactions. Think of it as creating a logical filing system for your money.

Your Chart of Accounts is the backbone of your accounting system. It turns financial chaos into organised clarity, ensuring every pound has a designated home and purpose.

Without a well-structured Chart of Accounts, your financial reports will be a meaningless jumble. Getting this right from day one is absolutely essential for keeping accurate accounts and making sense of how your business is actually performing.

Let’s look at a practical example: a small online shop that sells handmade candles. Here’s a simplified version of what their Chart of Accounts might look like.

A Practical Example: The Candle Retailer

We can break the accounts down into the main types we learned about earlier: Assets, Liabilities, Equity, Revenue, and Expenses.

- Assets (What you own)

- 1010 – Business Current Account

- 1200 – Inventory (Wax, Wicks, Jars)

- 1510 – Computer Equipment

- Liabilities (What you owe)

- 2010 – Business Credit Card

- 2200 – Business Loan

- Equity (The owner’s stake)

- 3010 – Owner’s Capital Contribution

- 3020 – Owner’s Drawings

- Revenue (How you make money)

- 4010 – Candle Sales

- 4020 – Shipping Fees Collected

- Expenses (What you spend money on)

- 5010 – Cost of Goods Sold (Materials)

- 5020 – Website Hosting Fees

- 5030 – Marketing & Advertising

- 5040 – Packaging Supplies

- 5050 – Bank Fees

When the store sells a candle for £20 plus £3 for shipping, the accounting software would record £23 hitting the “Business Current Account” (Asset). It would then split that income, categorising £20 to “Candle Sales” (Revenue) and £3 to “Shipping Fees Collected” (Revenue).

Likewise, when they buy £100 worth of wax, the system would show the “Business Current Account” (Asset) decreasing by £100 while the “Cost of Goods Sold” (Expense) increases by the same amount.

This organised structure is the foundation of your financial control centre. It makes sure every transaction is categorised correctly, leading to accurate, reliable reports you can use to make genuinely informed decisions for your business.

Mastering Your Daily Financial Rhythm

What’s the secret ingredient that separates a struggling business from a thriving one? It’s not a revolutionary idea or a massive marketing budget. It’s consistency.

Building a solid financial rhythm—a simple set of daily, weekly, and monthly habits—is what turns your accounting from a headache into a genuine strategic advantage. It’s not about spending entire weekends buried in spreadsheets. It’s about small, regular check-ins that keep you firmly in control of your money.

Think of it like regular maintenance on a car. This disciplined approach keeps your business engine running smoothly, helping you spot trouble long before it becomes a crisis. Any decent accounting for small business course will tell you the same thing: routine is the absolute bedrock of financial health.

The Power of Bank Reconciliation

One of the most important monthly habits you can build is bank reconciliation. At its heart, this is just the simple process of making sure the transactions in your accounting software perfectly match the transactions on your bank statement. It’s your financial safety net, confirming that your books reflect reality.

This monthly check-up is non-negotiable for catching errors, flagging strange transactions, and even preventing fraud. Skipping it is like driving with a dodgy fuel gauge; you might think you’ve got plenty in the tank, only to grind to a halt when you least expect it.

Bank reconciliation isn’t just about balancing the books; it’s about building trust in your own data. It verifies that your financial reports are accurate, giving you the confidence to make critical business decisions based on facts, not guesswork.

Let’s take Sarah, who owns a local bakery. While doing her monthly reconciliation, she spots a £50 payment to a supplier she’s never heard of. Because she caught it early, she was able to report it as fraud and her bank reversed the charge. Without that routine check, the money would have simply vanished.

Managing Money In and Money Out

Your daily and weekly rhythm should revolve around the two most important parts of your cash flow: the money people owe you (accounts receivable) and the money you owe others (accounts payable).

Accounts Receivable (Getting Paid)

This is all about making sure your customers pay you on time. Chasing late payments is one of the biggest cash flow killers for small businesses.

- Actionable Tip 1: Invoice Immediately. Don’t wait. Send invoices the moment a job is finished or a product is delivered.

- Actionable Tip 2: Offer More Ways to Pay. Make it dead simple for people to pay you, whether by bank transfer, card, or an online portal like Stripe.

- Actionable Tip 3: Set Clear Terms. Your invoice must clearly state the due date (e.g., “Payment due within 14 days”). No ambiguity.

- Actionable Tip 4: Follow Up Systematically. There’s no shame in sending polite reminders. Set a calendar reminder to send a follow-up email a day or two before the due date, and another one a week after if it’s still unpaid.

Accounts Payable (Paying Your Bills)

Managing what you owe is a balancing act. You need to keep suppliers happy by paying on time, but you also don’t want to drain your cash reserves too quickly. It’s about scheduling payments strategically—taking advantage of credit terms when you can, but always avoiding late fees. For instance, if a supplier offers a 30-day payment term, use it. Schedule the payment for day 28, keeping the cash in your account for as long as possible while still paying on time.

Handling UK Payroll Essentials

If you have employees, payroll is a critical part of your financial rhythm. Get it wrong, and you’ll have unhappy staff and serious problems with HMRC. In the UK, this all comes down to handling PAYE (Pay As You Earn).

PAYE is the system HMRC uses to collect Income Tax and National Insurance contributions directly from your employees’ wages. As the employer, it’s your legal responsibility to calculate these deductions, subtract them, and pay the remainder to your staff.

Here’s a simplified breakdown of the actionable steps:

- Register as an Employer: Before your first payday, you must register with HMRC online. This can take a few weeks, so do it early.

- Calculate Deductions: For each employee, use their tax code and earnings to calculate the tax and National Insurance they owe. Payroll software automates this complex step.

- Pay Your Employees: They receive their net pay (their gross salary minus all the deductions). Provide a payslip for each employee by law.

- Report to HMRC: You have to report all this payroll info to HMRC on or before each payday using a Full Payment Submission (FPS) through your payroll software.

- Pay HMRC: Finally, you pay the tax and National Insurance you’ve collected to HMRC, which is usually done monthly by the 22nd of the month.

Nailing this process keeps you compliant and your team happy, forming a vital part of a sustainable, well-run business.

Navigating UK Taxes and Compliance with Confidence

For many small business owners, the word “tax” brings on a cold sweat. It can feel like a labyrinth of rules and regulations designed to catch you out. The goal here is to swap that fear for confidence, breaking down the essentials of UK tax and compliance into simple, manageable pieces.

Getting your head around your tax obligations isn’t just about dodging penalties from HMRC; it’s a fundamental part of good financial management. The UK is a hotbed of entrepreneurial spirit, with over 753,000 new businesses launched in a recent year. But with a sobering 20% failing annually, it’s solid financial control that separates the survivors from the statistics. A practical grasp of tax, often gained through an accounting for small business course, is a critical survival skill. You can find more insights on this from UK small business statistics on pearllemonaccountants.com.

Corporation Tax vs. Self-Assessment: Which Path Are You On?

The kind of tax you’ll pay on your profits is decided entirely by your business structure. For most, it comes down to two main routes: Corporation Tax for limited companies and Self-Assessment for sole traders.

A limited company is a completely separate legal entity from you, its owner. The company itself pays Corporation Tax on all its profits. As a director, you then pay personal Income Tax on any salary or dividends you decide to draw from the company. If you’re running a limited company and want to get into the nitty-gritty, our detailed guide to Corporation Tax is a great next step.

A sole trader, on the other hand, is legally one and the same as their business. You pay Income Tax and National Insurance on all your business profits through the Self-Assessment system. This involves filling out an annual tax return that details your income and expenses, from which HMRC works out how much tax you owe.

Checkout the handy Limited Company Vs Sole Trader Calculator to understand the tax implications

Making the Most of Your Deductible Expenses

One of the most effective ways to legally reduce your tax bill is to properly understand what counts as an allowable business expense. In HMRC’s eyes, these are costs you’ve incurred “wholly and exclusively” for your business, and they work by reducing your taxable profit.

Think of deductible expenses as your reward for good record-keeping. Every legitimate expense you claim is a pound of profit that HMRC doesn’t tax, putting more money back into your pocket to reinvest and grow your business.

So many business owners leave money on the table by not claiming everything they’re entitled to. Here are a few commonly missed deductions with practical examples:

- Home Office Costs: If you work from home, you can claim a portion of your household bills. The simplest way is using HMRC’s flat rate (e.g., £26 per month if you work 101+ hours from home). Alternatively, you can calculate a percentage of your actual bills based on the proportion of your home used for business.

- Software Subscriptions: All those monthly fees for your accounting software (Xero), project management tools (like Trello), or design programs (like Adobe Creative Cloud) are fully deductible.

- Professional Development: The cost of an accounting for small business course or any other training that directly improves your skills for your business is an allowable expense.

- Mileage: Using your personal car for business trips? You can claim HMRC’s approved mileage allowance (currently 45p per mile for the first 10,000 miles). A 100-mile round trip to a client meeting earns you a £45 expense claim.

Your Common Accounting Questions Answered

Starting your journey into small business finances can feel like learning a new language. As you start putting the concepts from this guide into practice, questions are bound to pop up. This section is here to tackle the most common queries we hear from business owners, offering clear, practical answers to help you get past those early hurdles and make smarter decisions with confidence.

These questions often get into the nuts and bolts of applying what you’ve learned in an accounting for small business course. Let’s dive in.

Do I Still Need an Accountant After a Course?

Yes, absolutely—and it’s a very smart move. Think of it this way: taking an accounting course teaches you how to drive your business’s financial car every day. You learn how to check the oil (review your cash flow), understand the dashboard (read financial reports), and follow the rules of the road (stay compliant). This is a crucial, empowering skill that gives you day-to-day control.

An accountant, on the other hand, is your expert mechanic and performance strategist.

- They handle the complex engine diagnostics and performance tuning you’re not equipped for.

- They provide strategic tax planning to legally minimise what you owe.

- They navigate tricky compliance issues and can represent you during audits.

- They offer critical advice when you’re looking to secure a loan, sell the business, or make a major investment.

Finishing a course makes you a much better partner to your accountant. You can give them clean, organised books and ask more intelligent questions, which ultimately saves you money on their fees and leads to better advice.

Which Financial Report Is Most Critical?

While the Profit & Loss statement and Balance Sheet are essential, for a small business owner, the Cash Flow Statement is your lifeline. It gives you the unfiltered truth about whether your business can survive tomorrow.

Your Profit & Loss can show you are profitable on paper, but if your clients haven’t paid their invoices, you can’t pay your rent. The Cash Flow Statement tells you if you have the actual cash needed to operate next month. For a small business, cash isn’t just king—it’s the oxygen you need to breathe.

Profitability is a measure of long-term health, but positive cash flow is what ensures you survive long enough to see that profit. It tracks the actual money moving in and out of your bank account, flagging potential shortfalls before they become a full-blown crisis.

What Is a Realistic Bookkeeping Schedule?

For any new business, consistency is far more important than intensity. The main goal is to avoid that dreaded year-end scramble where you’re trying to make sense of a shoebox full of crumpled receipts. That frantic catch-up is not only stressful but also incredibly prone to costly mistakes.

A great rhythm to get into is setting aside one to two hours every single week. Actionable insight: Block out “Finance Friday” in your calendar from 2-4 pm every week. Use this time exclusively to update your books, send out new invoices, and chase any overdue payments.

This simple weekly habit achieves several vital goals:

- It keeps the task manageable: An hour a week feels easy. A 20-hour task at the year-end feels impossible.

- It gives you a real-time pulse: You can spot an overdue invoice or a rising supplier cost immediately, not six months later when it’s a serious problem.

- It ensures accuracy: It’s much easier to remember what a specific purchase was for when you bought it last Tuesday, not last February.

At the absolute minimum, you must reconcile your books monthly. Anything less than that, and you’re essentially flying blind, making critical business decisions with outdated and unreliable information.

Can I Just Use Spreadsheets to Save Money?

You can, but it’s often a false economy. Right at the very beginning, with only a handful of transactions each month, a spreadsheet might feel like enough. But the moment your business starts to grow, its limitations become painfully obvious.

Here’s a quick look at the real-world trade-offs.

| Aspect | Spreadsheets (e.g., Excel) | Accounting Software (e.g., Xero) |

|---|---|---|

| Time Investment | High – every transaction is a manual entry. | Low – bank feeds automate most data entry. |

| Error Risk | Extremely high – a single typo can throw everything off. | Very low – calculations are automated and accurate. |

| Insight Quality | Poor – creating reports is a complex manual task. | Excellent – professional reports are generated instantly. |

| Tax Compliance | Difficult – no built-in features for MTD or VAT. | Simple – designed for MTD/VAT submissions to HMRC. |

The monthly subscription for accounting software, which typically starts from £10-£30, is one of the best investments you can possibly make. It’s not just another expense; it’s a tool that buys you back time, reduces your stress, and gives you the professional-level insights you need to steer your business effectively.

Ready to take full control of your business’s foundation? From company formation and virtual offices to streamlined compliance, Acorn Business Solutions provides the essential tools UK entrepreneurs need to launch and grow with confidence. Let us handle the admin, so you can focus on building your vision. Explore our integrated business services today.