Your Guide to a Director Service Address

How to Dissolve a Company UK – Deciding to close your company is a big step, and the process of dissolving a company in the UK, often called ‘striking off’, is a specific route designed for solvent businesses. It’s a straightforward, administrative path for companies that are no longer needed but have enough cash to pay all their bills.

Is Dissolving Your Company the Right Move?

Before you get lost in the paperwork, it’s crucial to know if dissolution is actually the correct procedure for your situation. The key difference boils down to one thing: your company’s financial health.

Dissolution is only for solvent companies—those with enough assets to clear every last debt. If your company is insolvent and can’t pay its creditors, you’re legally required to go down the formal liquidation route instead.

This isn’t just a procedural detail; getting it wrong has serious legal consequences. Trying to dissolve an insolvent company can trigger an investigation and even lead to you being disqualified as a director.

Dissolution vs Liquidation: What’s the Difference?

It’s easy to get these terms mixed up, but they apply to very different financial situations. This table breaks down the main distinctions to help you figure out which path your company needs to take.

| Aspect | Dissolution (Striking Off) | Liquidation |

|---|---|---|

| Company’s Financial State | Solvent (can pay all its debts). | Insolvent (cannot pay its debts). |

| Who Initiates It? | Usually initiated by the company directors. | Can be initiated by directors (voluntary) or creditors (compulsory). |

| Primary Goal | To formally close a non-trading, debt-free company. | To wind up an insolvent company and fairly distribute assets to creditors. |

| Cost | Very low cost—typically just a small filing fee. | Much more expensive, as it requires a licensed insolvency practitioner. |

| Complexity | A simple, administrative process. | A complex legal process involving investigations and creditor meetings. |

Essentially, dissolution is a simple tidying-up exercise for a company that’s run its course, whereas liquidation is a formal, legally managed process for a business that has run out of money.

When Does Dissolution Make Sense?

Looking at real-world examples often makes the choice clearer. Dissolution is a fitting end for many small businesses whose purpose has simply ended.

Here are a few common scenarios I’ve seen over the years:

- A freelance consultant is ready to retire and has no plans to sell their limited company.

- A director is moving abroad for good and needs to shut down their UK operations.

- A “side-hustle” company, set up for a specific project that has now finished, is no longer active.

- The business has been dormant since it was formed, or it stopped trading at least three months ago.

Practical Example: Think of a small, two-person design agency. After five successful years, the founders decide to go their separate ways professionally. The agency is completely debt-free, has wrapped up all client contracts, and has a bit of cash left after paying its final tax bill. For them, applying for dissolution is easily the most efficient and cost-effective way to close the business down for good.

This is an increasingly common path. In the second quarter of 2025 alone, a staggering 185,336 companies were dissolved in the UK. That’s a significant jump from the previous year, highlighting the various economic pressures prompting directors to close their ventures. You can dig into the official numbers on the GOV.UK company statistics page.

A Quick Eligibility Checklist

To be eligible for dissolution, your company must confirm that it has not done any of the following in the last three months:

- Traded or carried on business in any capacity.

- Changed its company name.

- Sold off any company property or rights (this prevents directors from stripping assets before closing).

- Engaged in any other activity, except for those absolutely necessary to wind up its affairs (like seeking legal advice or finalising accounts).

Actionable Insight: Before you even start the process, log into your online banking and download the last three months of company bank statements. Go through them line by line. If you see any transactions other than settling old debts or receiving final payments for past work, you may not be eligible yet. This simple check can save you from a rejected application.

Getting Your Company Ready for Closure

A smooth, hassle-free dissolution all comes down to the prep work. Before you even think about filling in Form DS01, you need to tie up every single loose end. Trust me, getting this groundwork right from the start is non-negotiable if you want to avoid headaches and delays down the line.

The first step is simple but crucial: stop trading. This means your business can no longer generate any new income or take on any new expenses. The aim here is to bring all your operations to a complete, final halt. It’s the only way to pave the way for a clean closure.

Dealing with Assets and Debts

Now it’s time to tackle the balance sheet. Every asset and liability needs to be handled transparently and correctly.

Your first job is to liquidate any business assets you still have. This could be anything from selling off leftover stock and office furniture to company vehicles or equipment. Every penny from these sales must go straight into the company bank account. That cash is now earmarked for settling your debts.

With the cash in the bank, your priority is paying off anyone the company owes money to. This list includes:

- Suppliers and Lenders: Clear every single outstanding invoice and pay off any business loans or credit card balances.

- Employees: Make sure all final wages, holiday pay, and any redundancy payments are paid in full.

- HMRC: This is a big one. You must settle all final tax bills, which includes Corporation Tax, VAT, and PAYE/National Insurance contributions.

Practical Example: I worked with a small e-commerce business selling handmade crafts that decided to close. The owner kicked things off with a big clearance sale to shift her remaining stock. She then used that money to pay her packaging supplier’s final invoice and clear a small business loan. She made sure she had a zero balance everywhere before moving forward.

Finalising Your Company Accounts

Once all financial activity has stopped, you need to prepare and file your final statutory accounts and a Company Tax Return with HMRC. This final return needs to cover the period right up to the date your company officially ceased trading.

This part is absolutely critical: you must clearly state that these are the final trading accounts and that the company will be dissolved shortly. This is your official notice to HMRC. If you miss this step, HMRC will almost certainly object to the dissolution, bringing the whole process to a grinding halt.

Keeping meticulous records here is vital. If you’re unsure why, learning about the importance of keeping accurate accounts will make it crystal clear.

After every debt and tax bill has been paid, any money left over can be distributed among the shareholders. This must follow the ownership percentages laid out in your company’s articles of association. Only close the company bank account once it is completely empty.

Finally, you’ll need to officially deregister for VAT and cancel your PAYE scheme with HMRC. This confirms to the tax authorities that you’ve permanently wrapped things up. By taking care of these steps methodically, you’ll be in a solid position to dissolve your company without hitting any nasty surprises.

Getting Started with the Official Dissolution Process

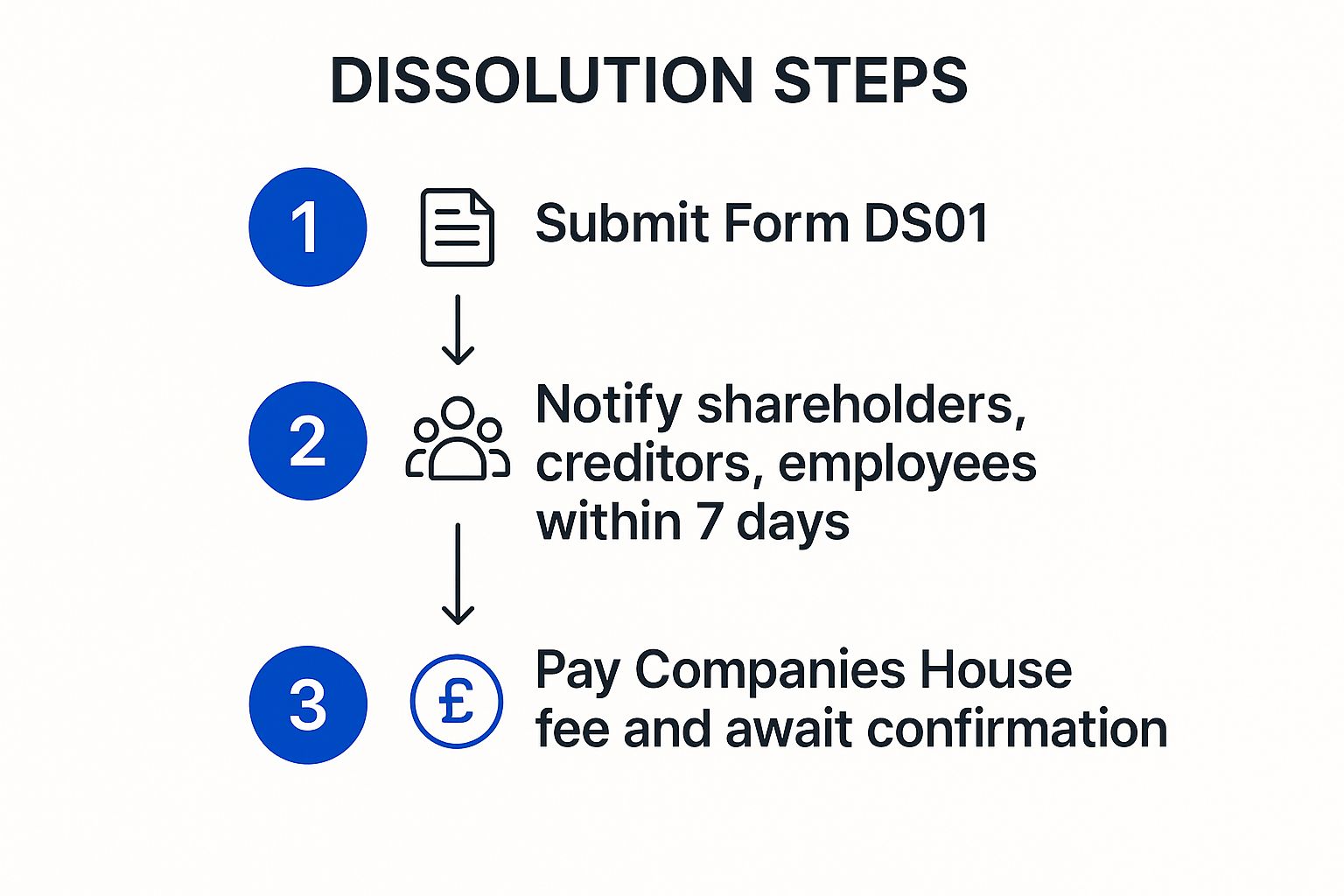

Once you’ve got all your ducks in a row, you can kick off the formal process of dissolving your company. The central piece of this puzzle is Form DS01. Think of it as your official request to Companies House to strike your company from the register. This is the point where your intention to close becomes a legal action.

You’ve got two ways to file: online or by post. Honestly, the online route is nearly always better. It’s faster, cheaper, and the Companies House system walks you through everything, which dramatically cuts down the chances of making a mistake. If you do go for the paper form, make absolutely sure you’ve downloaded the latest version from the GOV.UK website.

Submitting Form DS01 Correctly

Filling out the form itself isn’t complicated, but getting the details spot-on is critical. You’ll need your full company name, registration number, and the signatures of the directors. If your company has more than one director, a majority of them must sign the application.

This screenshot from the GOV.UK portal shows you exactly where to find and download the official Form DS01.

Stick to the official government source. Using an old form is a surefire way to get your application rejected right out of the gate.

There’s a small, non-refundable filing fee you need to pay Companies House when you submit the form. As of now, the fee is lower for online submissions, which is another reason it’s the go-to choice for most people. Don’t forget to pay it promptly, as they won’t even look at your application without it.

Notifying All Interested Parties

Filing the DS01 form is only half the job. By law, you are required to let all “interested parties” know that you’ve applied to dissolve the company. This isn’t just a formality; it’s a crucial step that ensures transparency and gives anyone with a stake in your business a chance to object.

Within seven days of sending your application to Companies House, you must send a copy of it to:

- Shareholders (members): Every registered owner of the company.

- Creditors: This includes your bank, any lenders, suppliers you owe money to, and HMRC.

- Employees: Your staff must be officially informed.

- Directors who did not sign the form: Every director has to be in the loop, even if they didn’t sign.

Practical Example: Imagine a freelance IT contractor decides it’s time to close his one-person limited company. He completes Form DS01 online and pays the fee. The same afternoon, he emails a PDF copy of the submitted form to his accountant (who is a creditor for their final fee) and posts a physical copy to his home address, which also serves as his registered office. By acting immediately, he’s comfortably met the 7-day deadline and ticked all the compliance boxes.

Failing to notify interested parties isn’t something to take lightly—it’s a criminal offence. It can lead to a hefty fine or even prosecution for the directors. Always keep proof of postage or email delivery records as evidence that you’ve fulfilled your legal duty.

It’s also vital that your contact details are current. Our guide on how to change a registered address with Companies House can help make sure all official notices and correspondence go to the right place during this critical period.

What to Expect After You Apply

So, you’ve filed Form DS01. That’s the official starting pistol, but the race isn’t quite over yet. Once your application lands with Companies House, a very specific sequence of events kicks off. Knowing this timeline is key to managing your own expectations and understanding what’s happening behind the scenes.

First things first, someone at Companies House will review your application to make sure it’s all filled out correctly. Assuming there are no issues, they’ll publish a notice of your proposed company strike-off in The Gazette.

If you’re not familiar with it, The Gazette is the UK’s official public record. This step makes your intention to dissolve the company public knowledge, and it’s a crucial part of the process.

The Two-Month Objection Period

The moment that notice appears in The Gazette, a critical waiting period begins. For the next two months, any interested party has the legal right to formally object to your company being dissolved. Think of this window as a legal safeguard designed to protect anyone your company might still owe money to, like creditors or even HMRC.

An objection puts an immediate pause on everything. Companies House won’t strike off your company until the person or organisation that raised the objection formally withdraws it.

So, who is likely to object? It usually comes down to a few common reasons:

- Unpaid Debts: This is the big one. A supplier, landlord, or HMRC can object if you haven’t settled your bills. They’ll use the objection to stop you from closing down before they get paid.

- Ongoing Legal Action: If the company is mixed up in any legal proceedings, the other side will almost certainly object to keep the company active until it’s resolved.

- Failure to Notify: Perhaps a shareholder or director wasn’t correctly informed about the dissolution. They can file a formal complaint to halt the process.

- Incorrect Procedure: If you slipped up and continued to trade, changed the company name, or broke any other eligibility rules after applying, this can be grounds for an objection.

A Practical Scenario: An Unexpected Objection

Let’s walk through a situation I’ve seen happen more than once. The director of a small marketing agency thought she’d done everything by the book. She’d paid off HMRC, cleared all known supplier invoices, and confidently filed the DS01 form. About a month later, a letter from Companies House arrived: the dissolution was suspended.

It turned out that an old software supplier, whose services they hadn’t used for over a year, had an automated annual subscription renewal. The invoice was sent to an old, unmonitored email address and went unpaid. The supplier’s finance team spotted the strike-off notice in The Gazette and, quite rightly, lodged an objection.

Actionable Insight: To resolve this, the director had to act fast. She immediately contacted the supplier, explained the oversight, paid the outstanding £250 invoice, and politely asked them to send a withdrawal of objection to Companies House. Once the supplier confirmed the debt was settled, the process could finally resume. This is a perfect example of why being absolutely meticulous is so important.

If no objections are raised within that two-month window—or if any that do pop up are resolved and withdrawn—Companies House will proceed. They’ll publish one last, final notice in The Gazette confirming the company has been dissolved. At that moment, your company legally ceases to exist.

Avoiding Common and Costly Mistakes

Knowing the steps to dissolve a company is one thing, but navigating the process without hitting a minefield is another. I’ve seen too many directors run into preventable roadblocks that lead to frustrating delays, outright rejections from Companies House, or even serious legal trouble.

Understanding these common pitfalls is the best way to guarantee a clean and final closure.

Not Telling Everyone You Need To

One of the most frequent and serious errors is failing to notify all interested parties correctly. This isn’t just bad etiquette; it’s a criminal offence. You are legally required to send a copy of your DS01 application to everyone from shareholders to creditors within seven days of filing.

Actionable Insight: Create a simple checklist of every person and entity you need to notify: shareholders, employees, HMRC, your bank, suppliers, and any other directors. As you send each copy of the DS01 form, tick them off the list and save proof of postage or the sent email in a dedicated ‘Company Dissolution’ folder. This creates an audit trail that can protect you if any issues arise.

Hidden Debts and Asset Mishandling

Another major pitfall is trying to strike off a company with hidden or forgotten debts. Dissolution is strictly for solvent companies. Trying to use it as a shortcut to escape liabilities is a serious misuse of the process and can lead to director disqualification or even personal liability for the company’s debts.

This is especially critical in the current economic climate. The consequences of financial distress are severe, and regulators are on high alert for directors trying to sidestep their responsibilities.

Equally damaging is the incorrect handling of company assets. Any assets left in the company’s name when it’s dissolved automatically become ‘bona vacantia’ (ownerless property) and legally pass to the Crown.

This includes things you might easily overlook:

- Cash left in a company bank account.

- Company-owned property or land.

- Intellectual property like trademarks or copyrights.

Reclaiming these assets is a complex, expensive legal battle that is entirely avoidable with a bit of proper planning.

Forgetting HMRC and Other Final Duties

Forgetting your final obligations to HMRC is a guaranteed way to have your application blocked. You must file final accounts and a Company Tax Return, making sure to mark them clearly as “final”. You also need to deregister for VAT and close your PAYE scheme. HMRC scrutinises every dissolution application, and any loose ends will trigger an immediate objection.

Directors can also fall for scams during this vulnerable period. It’s not uncommon to receive official-looking letters demanding payment for fictitious taxes or fees. Being vigilant is key. Our guide on how to spot scam HMRC letters has practical tips to protect yourself from fraudsters during the winding-down process.

By being meticulous and transparent, you can get through the dissolution journey without these costly and stressful mistakes.

Your Dissolution Questions Answered

Even with a clear plan, you’re bound to have a few questions when winding down a UK company. It’s completely normal. Let’s run through some of the most common queries we hear to clear up any confusion and make sure you’re confident about the process.

How Much Does It Cost to Dissolve a Company?

One of the best things about dissolution is how cost-effective it is. The main cost you can’t avoid is the statutory filing fee for Form DS01, which you pay directly to Companies House. It’s a minimal fee, especially if you file it online.

Of course, other costs might crop up depending on your situation. These could include:

- Accountancy Fees: Getting a professional to prepare your final accounts and Company Tax Return.

- Legal Advice: If there are any tricky aspects to your company’s closure, getting expert legal guidance is always a smart move.

But for a simple, clean closure, the direct costs are very low. It’s worlds away from the alternative of liquidation, which means hiring a licensed insolvency practitioner and can easily cost thousands of pounds.

How Long Does the Dissolution Process Take?

Once you’ve filed Form DS01, you should plan for the entire process to take at least two to three months. The biggest factor here is the mandatory two-month objection period. This starts as soon as your strike-off notice is officially published in The Gazette.

If nobody raises an objection during this window, Companies House will usually dissolve the company soon after it ends. But if an objection is filed, the process is put on hold indefinitely until the person or body who objected formally withdraws it.

What Are My Responsibilities as a Director After Dissolution?

Your company might legally cease to exist once it’s dissolved, but your duties as a director don’t disappear instantly. You have a legal obligation to hang onto your business records for a while.

Actionable Insight: Don’t just dump your old files in a box. Scan important documents like final accounts, tax returns, and legal paperwork to create digital backups. Store these securely in the cloud and keep the physical copies in a safe, dry place. Set a calendar reminder for seven years from the dissolution date so you know when it’s safe to dispose of them.

Can a Company Be Dissolved if It Has Debts?

This is a really important one: No, you absolutely cannot use dissolution to walk away from debts. The process is designed only for solvent companies that have paid off everything they owe. Trying to strike off a company that still has creditors, including HMRC, is a serious offence.

The UK’s insolvency figures show just why regulators are so strict on this. In May 2025, there were 2,238 company insolvencies, which is a 15% jump from the year before. Industries like construction and retail are feeling the pressure, making up a big chunk of these business failures. This just goes to show why the authorities are so vigilant about directors trying to misuse the dissolution process. You can learn more about the latest UK business insolvency statistics on witansolicitors.co.uk.

If your company can’t pay its bills, you need to speak to an insolvency practitioner and go down the formal liquidation route instead.

Closing down a company properly takes careful planning and attention to detail. At Acorn Business Solutions, we offer expert company dissolution services to make sure your business is closed correctly, efficiently, and in full compliance with UK law. Let us handle the paperwork and the process, so you can move on with peace of mind. https://acornbusinesssolutions.com