When Do You Have to be VAT Registered

When do you need to register for VAT? This is one of the most important financial milestones for any UK business. Getting it wrong can lead to some painful penalties from HMRC, so let’s break down exactly what you need to know about the VAT registration threshold.

Understanding the UK VAT Registration Threshold

First things first, let’s clear up a common misunderstanding. The VAT threshold isn’t tied to the tax year or your company’s financial year. It’s a rolling 12-month period.

Think of it like a moving window. At the end of every single month, you need to look back over the previous 12 months and add up your total sales. If that figure tips over the magic number, the clock starts ticking, and you’ll need to get registered. It’s a continuous calculation that you need to stay on top of as you grow.

The Current Compulsory Threshold

The compulsory VAT registration threshold is the specific turnover figure set by HMRC that, once you hit it, legally forces your hand. In April 2024, this figure went up for the first time since 2017.

In the UK, businesses must register for VAT if their taxable turnover exceeds £90,000 within any rolling 12-month period. Crucially, you must also register immediately if you expect to exceed this threshold in the next 30 days alone. You can learn more about the recent changes to the VAT threshold for businesses and what it means for you.

This forward-looking rule is really important. Imagine you’re a freelance consultant and you land a huge project, signing a single contract worth £100,000. You have to register for VAT right away. You don’t wait for the invoices to be paid or for the 12 months to pass because you already know your turnover will smash the threshold within the next 30 days.

To help you keep these key figures straight, here’s a quick reference table.

UK VAT Registration Threshold At a Glance

This table summarises the key figures related to UK VAT registration and deregistration, providing a quick reference for business owners.

| Scenario | Turnover Threshold | Action Required |

|---|---|---|

| Compulsory Registration (Historic) | Exceeds £90,000 in a rolling 12-month period | Must register for VAT |

| Compulsory Registration (Future) | Expect to exceed £90,000 in the next 30 days | Must register for VAT immediately |

| Voluntary Deregistration | Taxable turnover is below £88,000 | Can apply to cancel your VAT registration |

Keeping these numbers in mind will help you manage your VAT obligations proactively and avoid any nasty surprises from HMRC.

What Is Taxable Turnover?

So, what exactly counts towards that £90,000 limit? Your taxable turnover is the total value of all goods and services you sell that are not VAT-exempt. Getting this right is critical, as some of your income might not actually push you closer to the threshold.

Here’s what you absolutely must include in your monthly calculation:

- Standard-rated goods and services: This is most of what you’ll sell, like consultancy services, electronics, or clothes.

- Reduced-rated items: Things like children’s car seats or home energy.

- Zero-rated items: This is a tricky one. These are still ‘taxable’ for VAT purposes, but the rate is 0%. Think of things like most food, books, and children’s clothing. They still count towards your turnover.

- Goods you hired or loaned to customers.

- Business goods you’ve used for personal reasons.

- Any ‘free’ items or gifts you’ve provided.

What doesn’t count? VAT-exempt sales. Things like insurance, postage stamps, or certain financial services are excluded from the calculation. Understanding this difference is fundamental to tracking your turnover accurately and knowing exactly when you need to act.

How to Calculate Your VAT Taxable Turnover

Figuring out your taxable turnover is the single most important step in knowing when you need to register for VAT. It’s not as simple as just looking at your total sales; it’s a specific calculation that includes some types of income and leaves out others. Getting this right is non-negotiable for staying on the right side of HMRC.

Think of your taxable turnover as a running total of all sales that are subject to VAT, even if that rate is 0%. You need to keep an eye on this figure over a rolling 12-month period. This just means that at the end of every month, you look back over the last 12 months and add up your relevant sales to see if you’ve crossed the £90,000 threshold.

What to Include in Your Calculation

Your VAT taxable turnover must include the total value of everything you sell that isn’t VAT-exempt. This is a common trip-up for many businesses, so let’s break down exactly what counts.

You need to add up the value of:

- Standard-rated goods and services: This covers most things businesses sell, from consultancy services to coffee cups.

- Reduced-rated goods and services: Items like domestic fuel or children’s car seats fall into this bucket.

- Zero-rated goods and services: This one is crucial. Even though you don’t charge your customers any VAT on items like most food, books, or children’s clothing, their sales value still counts towards your £90,000 threshold.

On top of that, you have to include less frequent transactions, like selling a business asset, hiring out equipment, or even taking business stock for your own personal use. Keeping on top of all this is fundamental, which is why the importance of keeping accurate accounts from day one can’t be overstated.

Zero-Rated vs Exempt Sales A Key Difference

Getting your head around the difference between zero-rated and exempt sales is vital if you want an accurate turnover figure. While neither adds VAT to your customer’s bill, they are treated completely differently when it comes to registration.

Zero-rated sales are considered taxable for VAT, just at a rate of 0%. Because they are ‘taxable’, they absolutely must be included in your turnover calculation. In contrast, exempt sales are outside the scope of VAT entirely and should be left out of your calculation.

Common exempt items include things like postage stamps, insurance, and some financial or educational services. If your business only sells VAT-exempt goods or services, you can’t register for VAT at all.

A Practical Example Tracking Turnover

Let’s say you run a small online shop that you started in January. You sell standard-rated handmade gifts alongside zero-rated children’s books. Here’s how you’d track your turnover month by month:

| Month | Monthly Turnover | Rolling 12-Month Total |

|---|---|---|

| Jan | £6,000 | £6,000 |

| Feb | £7,000 | £13,000 |

| Mar | £8,000 | £21,000 |

| Apr | £8,500 | £29,500 |

| May | £9,000 | £38,500 |

| Jun | £9,500 | £48,000 |

| Jul | £9,000 | £57,000 |

| Aug | £10,000 | £67,000 |

| Sep | £8,000 | £75,000 |

| Oct | £9,000 | £84,000 |

| Nov | £7,000 | £91,000 |

Boom. At the end of November, your rolling 12-month turnover has tipped over £90,000 for the first time. The clock has now started ticking on your registration.

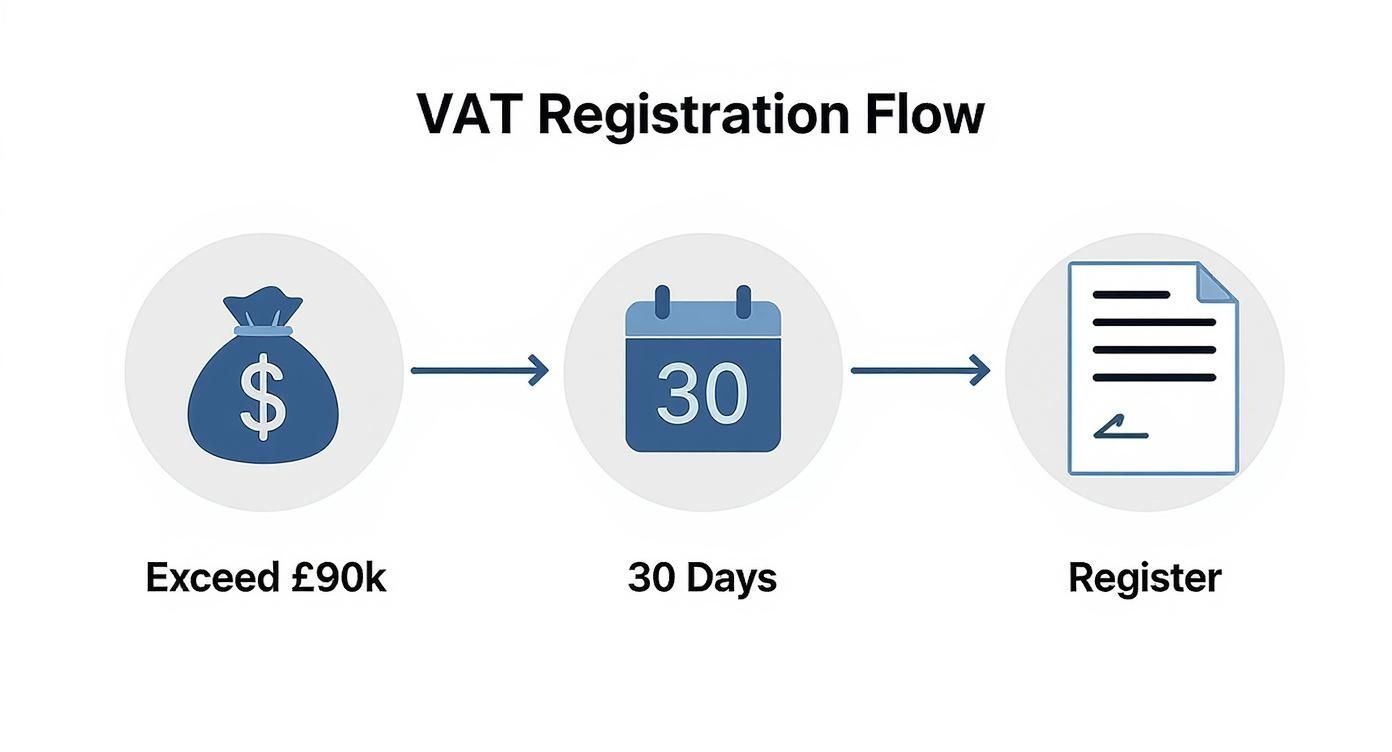

This infographic simplifies what you need to do the moment you cross that line.

As the diagram shows, from the moment you exceed the threshold, you have a strict 30-day window to get registered with HMRC. Don’t delay—acting quickly is the best way to avoid any nasty penalties.

Compulsory Versus Voluntary VAT Registration

Knowing when you have to register for VAT is one thing. Deciding if you should register before the law requires it is a totally different strategic ball game. This choice between compulsory and voluntary registration hinges entirely on your business model, who your customers are, and your ambitions for growth.

Compulsory registration is straightforward—it’s the law. Once your taxable turnover sails past the £90,000 threshold in any rolling 12-month period, the clock starts ticking. You have a strict 30-day deadline to get registered with HMRC. Dropping the ball here can lead to some hefty penalties, often calculated as a percentage of the VAT you should have been paying.

It’s a non-negotiable deadline, so you have to act fast. In this scenario, the law dictates your next move, taking the choice right out of your hands.

The Case for Registering Voluntarily

So, why on earth would anyone choose to take on the admin burden of VAT before they absolutely have to? Well, for the right kind of business, voluntary registration can unlock some powerful financial and reputational perks.

The single biggest draw is the ability to reclaim input VAT. Every penny of VAT you pay on business purchases—from laptops and software to stock and raw materials—can be claimed back from HMRC. This can give your cash flow a serious boost and bring down your operating costs.

The real win with voluntary registration is financial efficiency. If your business spends a lot on VAT-rated supplies but your customers are other VAT-registered businesses, registering early is a no-brainer. You can reclaim VAT on your costs without affecting your clients, as they can simply reclaim the VAT you charge them.

On top of that, being VAT registered can add a layer of credibility. Having a VAT number on your invoices can make your business look bigger and more established, which is a definite plus when you’re trying to win over large corporate clients or suppliers.

A Practical Example: The New Consultancy

Picture this: you’re launching a new IT consultancy. Before you even land your first client, you’ve got to shell out for high-spec computers, specialist software licences, and office kit, spending around £12,000. The VAT on that lot comes to £2,000.

If you register for VAT voluntarily from day one, you can claim that £2,000 straight back from HMRC. That’s a vital cash injection right when your business needs it most. And since your clients are likely to be other VAT-registered companies, they just reclaim the VAT you add to your invoices, meaning your pricing stays competitive.

Weighing the Downsides of Early Registration

Of course, voluntary registration isn’t a golden ticket for every business. The most obvious downside is the admin headache. You’ll need to keep immaculate records, issue proper VAT invoices, and file regular VAT returns with HMRC, which all takes time and effort.

Your customer base is another huge factor. If you mainly sell to the general public or small businesses that aren’t VAT registered, sticking 20% VAT on your prices could make you less competitive. Your customers can’t reclaim that VAT, so for them, it’s a straight-up price hike. For any B2C business, this can be a massive disadvantage.

Historically, the UK’s VAT registration threshold has been one of the highest among developed nations, sitting at £90,000 as of 2025. This high bar acts as a buffer for small businesses, shielding them from compliance costs. While the recent increase is expected to reduce the number of firms legally required to register, many—like the roughly 400,000 already registered voluntarily—still choose to opt in for the benefits.

Ultimately, the decision needs some careful thought. If you’re on the fence, it’s worth exploring the pros and cons of registering for VAT in the UK to help you weigh up the options. The right choice will always be the one that aligns with your specific business goals.

Understanding Special VAT Registration Rules

The standard £90,000 turnover threshold is straightforward enough, but VAT law has a few tripwires that can catch even seasoned entrepreneurs off guard. These special rules kick in for businesses in unique situations, like those based overseas or selling through online marketplaces. Getting a handle on these exceptions is vital, as they can trigger a compulsory registration, sometimes from your very first sale.

For most UK businesses, the question of “when do I need to register for VAT?” is a simple numbers game based on turnover. But for others, your location and how you sell are far more important. It’s a classic mistake to assume the standard threshold applies to everyone.

Rules for Non-UK Businesses

If your business is based outside the UK but you’re supplying goods or services to UK customers, the rulebook changes completely. For many international businesses, that £90,000 threshold is totally irrelevant.

The moment you supply any goods or services to the UK, you must register for VAT here. It doesn’t matter what your turnover is. This means that from your very first transaction, you are legally required to sign up and start accounting for UK VAT. This is a critical point for any international seller looking to tap into the British market.

Picture this common scenario: an e-commerce store in the US starts shipping products directly to customers in the UK. Even if they only sell a single £10 item, they have an immediate obligation to register for UK VAT. Ignoring this can lead to some serious compliance headaches down the line.

This rule exists to ensure overseas businesses compete on a level playing field with domestic companies, who have to charge VAT once they cross the threshold. For international entrepreneurs, it’s a non-negotiable first step for UK market entry.

Navigating Online Marketplaces and Distance Selling

The boom in online marketplaces like Amazon, eBay, and Etsy has added another layer to the VAT puzzle. If you sell goods through an online marketplace (OMP), the responsibility for handling the VAT can sometimes shift from you to the platform itself.

This usually happens in two main situations:

- When goods worth £135 or less are imported into Great Britain and sold directly to consumers.

- When an overseas seller sells goods of any value that are already physically in the UK when the sale is made.

In these instances, the online marketplace is treated as the supplier for VAT purposes. That means the platform is on the hook for charging, collecting, and paying the VAT to HMRC. While this can simplify things for you, it’s crucial to know exactly when these rules apply so you don’t end up accounting for VAT when the marketplace is already doing it.

This system was brought in to make VAT collection on low-value imported goods more efficient, but it puts the onus on sellers to understand their obligations on each platform they use.

Businesses Selling Only VAT-Exempt Items

So, what happens if your business exclusively sells goods or services that are exempt from VAT? This category covers things like insurance, certain financial services, postage stamps, and some health services.

If everything you sell falls under the VAT-exempt banner, you simply cannot register for VAT. Because you don’t make any ‘taxable supplies’ (which includes standard, reduced, and zero-rated items), you are completely outside the scope of the VAT system. You don’t need to worry about the registration threshold at all.

There is a downside, though. You can’t reclaim any input VAT on your business purchases. If you buy a new computer or pay for marketing services, you have to absorb the full cost, including the VAT. This is a key difference from businesses making zero-rated sales (like children’s clothes), which can reclaim input VAT even though they don’t charge VAT to their customers.

Your Step-by-Step Guide to VAT Registration

So, you’ve realised you need to register for VAT. The process itself can look a bit daunting, but if you break it down into a clear, manageable checklist, you can get through it smoothly and sidestep the common pitfalls.

The secret to a stress-free registration is all in the prep work. Before you even think about heading over to the HMRC online portal, take some time to get all your information together. Having everything ready to go will save you a world of frustration and prevent unnecessary delays.

Assembling Your Registration Toolkit

Think of this first step like getting your ingredients ready before you start cooking – it just makes the whole thing faster and a lot more efficient.

Here’s what you’ll almost certainly need:

- Unique Taxpayer Reference (UTR): You’ll have one of these whether you’re a sole trader or a limited company.

- Business Details: This covers your registered business address, contact info, and your company registration number if you have one.

- Bank Account Information: HMRC needs your business bank account number and sort code.

- Turnover Figures: You’ll need to provide your taxable turnover for the last 12 months and a solid estimate for the next 12.

- Business Activity Description: Be prepared to describe what your business actually does, using the correct Standard Industrial Classification (SIC) code.

Once you’ve got this little lot organised, the online application turns into a simple box-ticking exercise instead of a mad dash to find paperwork.

Navigating the HMRC Online Portal

Registration is handled online through the Government Gateway. The portal itself is pretty good at guiding you through a series of questions about you and your business. It’s vital to answer everything accurately, as any mistakes could see your application delayed or even rejected.

You’ll be asked to confirm why you’re registering – is it compulsory because you’ve hit the threshold, or are you doing it voluntarily? One of the most critical details you’ll enter is your Effective Date of Registration (EDR).

Your Effective Date of Registration is the official start of your VAT duties. From this date, you must charge VAT on your sales and can start reclaiming VAT on your business purchases, even if your VAT number hasn’t arrived yet.

For a compulsory registration, your EDR is usually the first day of the second month after you cross the threshold. If you register late, be warned: HMRC will backdate your registration to when you should have registered, and that often comes with penalties.

What to Expect After You Apply

Once you hit ‘submit’, your VAT number won’t pop up instantly. Now the waiting game begins, but that doesn’t mean your responsibilities are on hold.

You should get a quick acknowledgement from HMRC to say they’ve received your application. The full processing time can vary, but it often takes around 30 working days to get your official VAT registration certificate in the post. This certificate is the document that confirms your VAT number and your EDR.

During this waiting period, you still have to account for VAT on any sales you make from your EDR. Since you can’t issue a proper VAT invoice without a number, the correct approach is to increase your prices by 20% and clearly state on the invoice that your VAT registration is pending. As soon as you get your number, you can then reissue these invoices with all the correct VAT details. This makes sure you collect what you owe from day one and stay compliant while the paperwork catches up.

Life After VAT Registration: What Happens Next?

So, you’ve got your VAT number. Congratulations! But don’t pop the champagne just yet. Getting registered isn’t the finish line; it’s the starting gun for a whole new set of financial duties. From this point on, VAT becomes a part of your daily business life.

This is a big shift in how you handle your money. Every sale you make will now need to include the correct VAT rate, and every business purchase you make becomes an opportunity to reclaim the VAT you’ve paid out. It requires a much more disciplined approach to your bookkeeping.

Your Core VAT Obligations

Once you’re in the club, you have three fundamental responsibilities that are non-negotiable. Getting these right from day one is essential, as getting them wrong can lead to some painful penalties from HMRC.

Your new duties boil down to this:

- Charging the correct VAT: You must add the right amount of VAT—usually 20%—to all goods and services you sell that aren’t exempt or zero-rated.

- Issuing compliant VAT invoices: Your invoices now need to meet specific criteria. They must clearly show your VAT registration number and a proper breakdown of the VAT charged.

- Keeping meticulous records: HMRC requires you to keep detailed VAT records of all your sales and purchases for at least six years. No excuses.

This change obviously impacts your company’s financial setup. To see how these new tasks fit into the bigger picture, it’s worth understanding the broader tax implications of forming a UK limited company.

Submitting VAT Returns to HMRC

The centrepiece of your new VAT life is the VAT return. This is the regular report, usually filed every three months, that you’ll send to HMRC to summarise all your VAT activity.

Think of it as a balancing act. Your return calculates whether you owe HMRC money or if they owe you a refund. It works by subtracting the total VAT you’ve paid on your business purchases (input VAT) from the total VAT you’ve collected from your customers (output VAT).

If your output VAT (what you’ve collected) is more than your input VAT (what you’ve paid), you pay the difference to HMRC. If your input VAT is higher—maybe you made some big investments that quarter—HMRC refunds you the difference.

It’s important to know that all VAT returns must now be submitted online using Making Tax Digital (MTD) compatible software. The days of paper-based bookkeeping for VAT are long gone.

Choosing the Right VAT Accounting Scheme

To make life a little easier, HMRC offers several VAT accounting schemes designed for different types of businesses. Picking the right one can seriously cut down on your admin time and even give your cash flow a boost.

Here are the most common options:

- Cash Accounting Scheme: A real lifesaver for cash flow. You only account for VAT when money actually moves. You record VAT on sales when a customer pays you, and you reclaim VAT on purchases when you pay your supplier. It’s perfect if you often deal with slow-paying clients.

- Flat Rate Scheme: This one’s for smaller businesses with a turnover below £150,000. You pay a fixed, lower percentage of your turnover to HMRC, but the trade-off is that you can’t reclaim input VAT on most of your purchases. It makes record-keeping much, much simpler.

- Annual Accounting Scheme: If you can’t stand quarterly deadlines, this might be for you. You only submit one VAT return per year. You’ll still make advance payments towards your final bill, but it drastically reduces the amount of regular paperwork.

Taking the time to figure out which scheme fits your business is a smart move. The right choice can turn VAT from a dreaded chore into a manageable part of your financial routine, freeing you up to focus on what really matters—growing your business.

Your Top VAT Registration Questions Answered

When you’re getting your head around VAT, it’s natural for a few specific questions to pop up. Let’s tackle some of the most common ones that business owners ask when they’re figuring out their obligations.

Can I Backdate My VAT Registration?

Yes, you absolutely can. In fact, if you’ve already crossed the £90,000 threshold and haven’t registered yet, backdating is mandatory. HMRC will set your registration date to the day you should have registered, which means you’ll owe VAT on all sales made since then.

You can also choose to voluntarily backdate your registration, sometimes by up to four years. Why would you do this? It’s often a smart move for startups that spent a lot on equipment or stock before they started trading. Backdating allows you to reclaim the VAT you paid on those initial costs.

The Bottom Line: Backdating lets you reclaim past input VAT, but be warned: it also makes you liable for output VAT on every single sale from that date. You’ll need flawless records to pull this off without a headache.

What Happens if I Register for VAT Late?

Let’s be direct: registering late almost always leads to a penalty from HMRC. This isn’t just a slap on the wrist; the penalty is a percentage of the VAT you owe, calculated from the date you were supposed to have registered.

The longer you leave it, the higher that percentage climbs. While HMRC might be lenient if you have a genuinely “reasonable excuse,” simply not knowing the rules won’t cut it. The moment you realise you’ve missed the deadline, it’s critical to act fast.

How Long Does VAT Registration Take?

Once your online application is in, you can typically expect HMRC to process it and send your VAT registration certificate within about 30 working days. But don’t bank on that exact timeline, as it can vary.

Here’s the crucial part: your VAT responsibilities kick in from your Effective Date of Registration, not from when the certificate lands on your doormat. You must start accounting for VAT on your sales from that date, even without your official VAT number. So, don’t wait for the postman before you adjust your pricing.

Navigating company formations, compliance, and the day-to-day admin of running a business can feel overwhelming. At Acorn Business Solutions, we offer a full suite of services—from virtual offices to company formations—built to support UK startups and SMEs. Let us handle the admin so you can get back to growing your business. Explore our solutions at https://acornbusinesssolutions.com.