What is a Company Secretary?

The Modern Company Secretary Explained

Many founders and directors think the company secretary is just an administrator. A glorified note-taker. But that view misses the point entirely and overlooks the strategic power of the role.

Think of the company secretary less as a scribe and more as the ‘mission control’ for your business. They’re the central hub ensuring all systems are go for legal compliance, corporate governance, and smooth operations. This person is the chief advisor to the board of directors on all things governance, acting as the guardian of your company’s legal health as it navigates the tangled web of UK regulations.

More Than Just an Administrator

The modern company secretary is no longer a reactive filer of documents. They are a proactive manager of risk and a critical facilitator of good decision-making, ensuring the company operates ethically, transparently, and, most importantly, within the law.

Their core functions are anything but basic admin:

- Ensuring Statutory Compliance: This is about more than just paperwork. It’s managing every filing with Companies House, from confirmation statements to annual accounts, and getting them right every time. For instance, a practical action is setting up calendar alerts 6-8 weeks before filing deadlines to gather necessary information without a last-minute rush.

- Maintaining Company Records: They keep the statutory registers – the company’s official legal record – perfectly up to date. This includes crucial details on directors and Persons with Significant Control (PSCs). An actionable insight here is to conduct a quarterly review of these registers against board meeting minutes to ensure any changes, like a director’s new address, have been captured.

- Supporting the Board: This involves preparing sharp meeting agendas, circulating board papers with time to spare, and making sure every meeting follows the correct legal protocols. A practical example is creating a standardised board pack template that includes an agenda, previous minutes, and financial reports, which is then sent to directors at least five working days before the meeting.

- Advising Directors: A key part of the job is guiding the board on their legal duties, spotting potential conflicts of interest, and keeping them ahead of changes in corporate law. For example, if a director is also a shareholder in a potential supplier, the secretary would advise them to declare this interest and recuse themselves from the vote on that contract.

This role is the essential bridge connecting the company, its board, its shareholders, and the regulatory authorities. They make sure communication flows properly and that the board’s decisions are implemented and recorded correctly. For any growing business, getting this right builds the solid foundation you need for the future.

Legal Status and Strategic Value

Historically, every UK company had to have a company secretary. That changed with legislative reforms, and now the role is only a legal requirement for public limited companies (PLCs). Private limited companies can choose whether to appoint one, but this decision carries real strategic weight. For a deeper dive into current company statistics, you can explore the official UK companies register activities.

To give you a clearer picture, here’s a quick summary of what the role entails.

Role of a Company Secretary at a Glance

| Aspect | Description |

|---|---|

| Primary Function | To ensure the company complies with all statutory and regulatory requirements. |

| Key Responsibility | Advising the board of directors on corporate governance and their legal duties. |

| Legal Status (UK) | Mandatory for Public Limited Companies (PLCs). Optional for Private Limited Companies (LTDs). |

| Reporting Line | Typically reports directly to the Chairman or the board of directors. |

| Strategic Importance | Acts as the guardian of the company’s compliance, reducing risk and building investor confidence. |

This table shows that while optional for many, the role’s strategic importance shouldn’t be underestimated.

For private companies, especially those chasing investment, planning rapid growth, or eyeing a future sale, appointing a company secretary is a powerful strategic move. It signals a serious commitment to strong governance—a quality that investors and potential buyers actively look for.

Ultimately, even if appointing a company secretary isn’t mandatory for your small business, the functions they perform absolutely are. The real question for directors isn’t if these tasks should be done, but who is best placed to do them.

Core Duties and Responsibilities Unpacked

Knowing what a company secretary is is one thing, but seeing their mission in action is something else entirely. To really get a feel for their value, we need to shift from the ‘what’ to the ‘how’. The role is essentially built on four key pillars that keep a company compliant, properly documented, and well-governed.

These aren’t just separate jobs on a to-do list; they’re interconnected responsibilities that form the very backbone of good corporate administration. Let’s break each one down to see how they work in the real world.

Maintaining Companies House Filings

One of the most visible and critical jobs is handling all the back-and-forth with Companies House, the UK’s official registrar of companies. This is more than just posting a form now and then; it’s about making sure the company’s public record is spot-on accurate and always on time.

Key filings include:

- Confirmation Statement: An annual check-in that confirms all the company’s key details—like its registered office, directors, and shareholder info—are still correct.

- Annual Accounts: Filing the company’s financial statements before the legal deadline hits.

- Event-Driven Filings: Alerting Companies House to any big changes, such as appointing a new director (Form AP01) or altering the company’s share structure.

Dropping the ball here has immediate consequences. For instance, filing annual accounts late triggers an automatic penalty, starting at £150 for private companies and climbing the longer you wait. A practical insight is to use Companies House’s email reminder service, but a good company secretary will also maintain their own internal compliance calendar as a primary tool, not just a backup.

Upkeep of Statutory Registers

While Companies House keeps the public-facing record, the company has to maintain its own set of internal legal records, known as statutory registers. Think of them as the company’s official, detailed logbook. The company secretary is the meticulous keeper of these crucial documents.

These legally required registers include:

- The register of members (who the shareholders are).

- The register of directors and their residential addresses.

- The register of Persons with Significant Control (PSCs).

This isn’t a “set it and forget it” task. For example, if shares are transferred as part of a director’s exit, the secretary must update the register of members, prepare a new share certificate, and ensure the old one is cancelled. Inaccurate registers can cause serious legal and operational headaches, especially when you’re facing an audit, trying to secure funding, or selling the company.

Supporting the Board and Shareholders

Beyond paperwork, the company secretary plays a central part in the mechanics of corporate decision-making. They are the facilitator, making sure board and shareholder meetings don’t just happen, but are productive and legally watertight.

Their role is to transform a simple meeting into a formal, compliant, and effective governance event. This means preparing agendas that drive focused discussion, circulating board papers in advance, and ensuring proper legal protocols are followed from start to finish.

This support also includes taking detailed and accurate minutes. These aren’t just notes; they are the legal record of the board’s decisions and can be vital evidence if any disputes pop up later. A practical example of this is ensuring that minutes clearly record not just the final decision, but the key discussion points and any dissenting votes. This creates a robust record that demonstrates the board exercised due care. For a deeper dive, you can read more about the detailed UK company secretary duties and responsibilities.

Championing Corporate Governance

Finally, the company secretary acts as the company’s conscience and go-to advisor on corporate governance. This is probably their most strategic function. They guide the board on its legal and ethical duties, making sure directors fully understand their responsibilities under the Companies Act 2006.

This involves advising on potential conflicts of interest, keeping the board updated on new laws that affect the business, and fostering a culture of transparency and accountability. For example, if a director has a personal stake in a contract the company is thinking about, the secretary ensures it’s declared and managed correctly according to the company’s articles of association. In doing so, they shield both the directors and the company from legal risk, building a solid foundation for sustainable growth.

When Do You Need to Appoint a Company Secretary?

Figuring out whether you need a company secretary can feel like navigating a minefield, but the rules are actually clearer than you might think. For some companies, it’s a legal must-have. For most others, it’s a strategic move that signals a major step up in their growth story.

The legal side is black and white: if you run a public limited company (PLC), you are legally required to appoint a qualified company secretary. There are no ifs or buts here; it’s a non-negotiable part of operating as a PLC in the UK.

For the vast majority of businesses, though, the picture is different.

The Tipping Point for Private Companies

If you run a private limited company (LTD), appointing a company secretary has been optional since the Companies Act 2006 came into force. This gives directors the flexibility to handle compliance duties themselves, which usually works just fine when a startup is in its early days.

But as a business grows, you’ll eventually hit a tipping point. The administrative load gets too heavy for the founders to juggle alongside their real jobs—growing the business. This is when the decision stops being about the law and starts being about smart strategy.

Let’s look at a classic example. Imagine a tech startup, “Innovate Ltd,” run by two founders. For the first couple of years, they do it all: product development, sales, and their own Companies House filings. Then, everything changes:

- They start a funding round: Suddenly, potential investors are asking for detailed, perfectly organised records. The due diligence process demands spotless statutory registers, board minutes, and governance policies. The founders quickly realise they need an expert to get their house in order, fast.

- Their shareholder structure gets complicated: After landing the investment, they now have a diverse group of shareholders, all with different rights. Managing shareholder communications and making sure every meeting and resolution is legally watertight becomes a specialised job in itself.

- The business begins to scale: Innovate Ltd hires more people, opens a new office, and starts looking at international sales. The compliance burden grows with every move, and the risk of a simple—but costly—administrative mistake becomes too big to ignore.

This journey shows how complexity is the real trigger. The founders of Innovate Ltd didn’t hit a legal deadline; they hit an operational wall. The time they were burning on admin was time they weren’t spending on innovation. This is the exact moment a company secretary goes from a “nice-to-have” to a strategic necessity.

Recognising Your Company’s Inflection Point

Your own business might be creeping towards this inflection point if you’re facing similar challenges. The UK is home to around 5.43 million companies as of early 2025, and the vast majority are private limited companies where this role is optional. But as they scale and face more intricate compliance, bringing in a company secretary becomes increasingly common. You can get a sense of the UK’s corporate landscape by checking out the latest official government statistics on company register activities.

Appointing a company secretary is about more than just offloading paperwork. It’s a proactive step towards building a solid governance framework that supports future growth, attracts serious investment, and protects directors from personal liability.

When you start to recognise these triggers in your own company, the topic shifts from a dry legal requirement to a practical business decision. It’s about knowing when to bring in specialist help so you can get back to what you do best: driving your business forward.

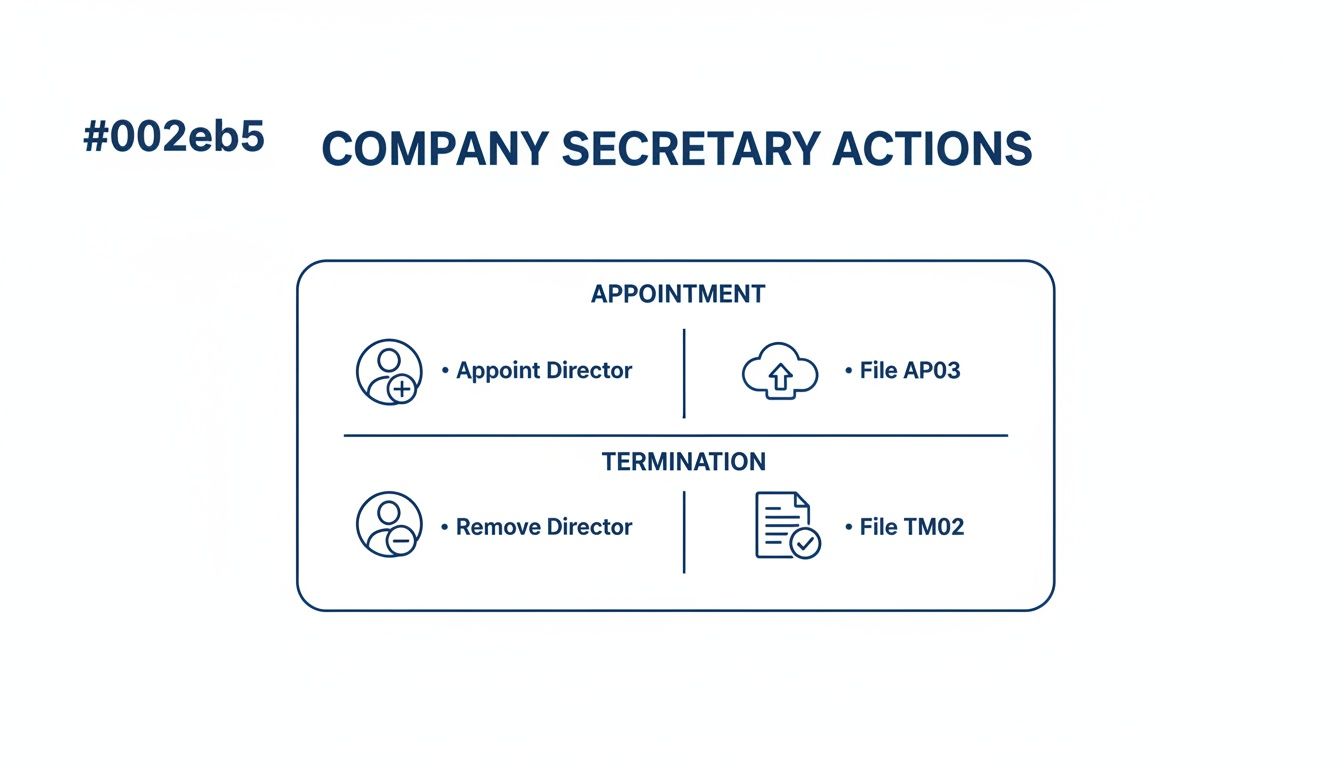

Getting the Appointment and Removal Process Right

Bringing a company secretary on board—or managing their departure—isn’t a casual affair. It’s a formal process that has to be done by the book to keep your company compliant. Think of it like updating your property deeds; every change needs to be officially recorded so that your internal and public records are perfectly aligned.

This isn’t just about a handshake and a “welcome aboard.” There’s a specific sequence of steps that creates a clear legal paper trail, protecting both the company and the individual stepping into the role.

The Formal Appointment Procedure

To get a new company secretary properly set up, you need to follow a clear, four-step process. Sticking to this ensures the appointment is legally sound from day one.

- Pass a Board Resolution: The decision has to be made official at a board of directors’ meeting and properly minuted. This resolution confirms the appointment, the start date, and any other key terms, creating the first essential piece of the legal puzzle.

- Get It in Writing: The person you’ve chosen needs to formally accept the role. A signed letter of consent from them confirms they’re happy to take on the duties and responsibilities. This letter should be filed away safely with your company’s official records.

- Update Your Own Books First: Before you tell the world, you need to update your internal records. The company’s register of secretaries must be updated straight away with the new person’s details.

- Notify Companies House: You have 14 days from the appointment date to file a Form AP03 (Appointment of secretary) with Companies House. This is the step that makes it official on the public record.

How to Handle a Resignation or Removal

The process for when a company secretary leaves is just as crucial. Whether they resign or the board removes them, the steps largely mirror the appointment process to ensure a clean break and keep your records straight.

Again, a board resolution should be passed to formally accept the resignation or confirm the removal. The most important final step is telling Companies House by filing a Form TM02 (Termination of appointment of secretary) within 14 days. This action officially removes them from the public register, severing their legal ties to the company.

Common Pitfalls to Avoid

It’s surprisingly easy to trip up on the admin here, but simple oversights can cause big headaches, from compliance issues to confusion over who officially holds the reins.

The most common mistake we see is a disconnect between what’s decided in the boardroom and what’s filed publicly. A board appoints a new secretary and thinks the job’s done, completely forgetting that until Form AP03 is filed, the appointment has no legal weight on the public record.

Here are a few slip-ups to watch out for:

- Forgetting to Update Internal Registers: So many businesses focus on the Companies House filing and completely overlook their own statutory books. This creates conflicting records, which is a nightmare if you’re ever going through due diligence or an audit.

- Missing the 14-Day Filing Deadline: Filing forms AP03 or TM02 late is a breach of the Companies Act 2006. While you might not get an instant fine, being consistently late looks sloppy and can harm your company’s compliance reputation. A practical insight is to file these forms electronically via Companies House WebFiling, as it’s faster and provides an immediate confirmation of submission.

- Sloppy or Inaccurate Filings: Submitting forms with mistakes—like a misspelled name or the wrong date of appointment—will likely get them rejected. This causes delays and means you have to do it all over again. Get it right the first time.

The Smart Alternative: Outsourcing the Company Secretary Role

For most startups and small businesses, hiring a full-time, in-house company secretary just isn’t on the cards. It’s a hefty salary commitment and another layer of overhead that a lean, growing company can’t justify. But here’s the thing: the crucial compliance duties they handle don’t just vanish because your business is small.

This is where outsourcing the role becomes a seriously smart move. It’s not just about trimming costs; it’s about getting access to a level of expertise and efficiency that would otherwise be completely out of reach. When you bring on an outsourced provider, you’re tapping into a specialist who lives and breathes corporate governance, all without the financial weight of a senior hire.

For founders, this approach solves a ton of common headaches right away. It guarantees that critical compliance deadlines are never missed, and it provides continuity even if your internal team members change. Most importantly, it pulls the directors out of the administrative weeds, freeing them up to focus their energy on what really drives the business forward.

In-House vs Outsourced Company Secretary: A Cost-Benefit Analysis

When you start to look at the numbers, the case for outsourcing gets even stronger. Hiring a dedicated company secretary is a major investment. According to recent industry figures, even a mid-level secretary in a private company can command a salary between £40,000 and £70,000 a year. And that’s before you add National Insurance, pension contributions, and all the other costs that come with an employee.

Contrast that with an outsourced service, where you get access to the same professional know-how for a predictable, fixed fee—often just a fraction of what an in-house salary would cost. This model lets a growing business tap into high-level expertise on a flexible basis, paying only for the support it genuinely needs.

It’s worth digging into the latest salary trends for company secretaries to see the full financial picture. The comparison makes the choice pretty clear for most small businesses.

Here’s a straightforward breakdown of what you’re weighing up:

| Factor | In-House Company Secretary | Outsourced Service |

|---|---|---|

| Cost Structure | High fixed salary plus NI, pension, benefits, and training costs. | A predictable, fixed monthly or annual fee. A manageable operational expense. |

| Expertise Level | Dependent on the individual hired. May have limited exposure to diverse scenarios. | Access to a team of specialists with broad industry experience. Always up-to-date. |

| Flexibility & Scalability | A rigid cost. Difficult to scale down if needs change. | Highly flexible. Services can be scaled up or down as the business grows. |

| Continuity | Risk of disruption if the person leaves, gets sick, or goes on holiday. | Guaranteed continuity. The service provider manages staffing and cover. |

| Admin Overhead | Requires managing another employee, including payroll, HR, and performance. | Zero internal admin. The provider manages their own team and resources. |

| Value Proposition | A dedicated internal resource focused solely on your company. | Cost-effective access to top-tier expertise, freeing up capital for growth. |

Ultimately, the real value of outsourcing lies in transforming a large, fixed cost into a manageable operational expense. For startups and SMEs, that kind of financial agility is gold, allowing you to maintain perfect compliance while funnelling cash into growth.

The Power of Bundled Services

The perks of outsourcing don’t stop at handling statutory filings. Many providers offer integrated solutions that create a single, streamlined compliance hub for your business. This is a game-changer for international founders setting up in the UK or for any entrepreneur who wants a truly hands-off approach to administration.

Imagine a single service that doesn’t just act as your company secretary but also gives you:

- A Registered Office Address: A professional and compliant address for all your official government mail.

- Mail Handling and Forwarding: A dedicated team to receive, scan, and send on all official correspondence, so you never miss a critical notice from Companies House or HMRC.

- Complete Filing Management: Proactive handling of all necessary filings, from confirmation statements to director changes, ensuring you’re always compliant.

This is exactly the kind of expert handling you need for routine but critical changes, like appointing or removing a director.

As you can see, every formal change requires a specific action and the right form. Getting this wrong can cause major headaches, which is why having an expert on your side is so valuable.

By bundling these functions, you create a seamless system that manages your company’s core administrative and legal duties under one roof. It simplifies your operations, cuts down the risk of errors, and gives you, the director, complete peace of mind. Taking a look at the full range of corporate services available can help you find a package that’s a perfect fit, offering a complete solution for your compliance needs.

Understanding Director Liabilities and Risks

One of the most critical things for any director to grasp is a simple but stark legal truth. While a company secretary performs the duties, the directors ultimately carry the legal responsibility for the company’s compliance.

This is a common and dangerous misconception. Many boards believe that by appointing a secretary, they’ve successfully offloaded the risk. In reality, the buck always stops with the directors. If your company secretary misses a filing deadline or keeps inaccurate records, it is the board, not the secretary, who will face the music from regulators.

The Direct Link Between Secretarial Duties and Director Risk

Failures in company secretarial tasks can quickly spiral into serious personal liabilities for directors. These aren’t just minor administrative hiccups; they are breaches of your legal duties as a director, and the penalties can be severe.

Imagine a straightforward scenario. The company’s annual accounts are due, but your company secretary fails to file them on time. This isn’t just an internal issue; it triggers an immediate, automatic penalty from Companies House. If the delay continues, that penalty grows, and the company gets flagged as non-compliant on the public register.

The real danger for directors isn’t just the financial penalty. Persistent failure to file statutory documents can be grounds for prosecution and, in serious cases, lead to a director being disqualified from acting as a director for up to 15 years.

This example shows how a simple secretarial task, when bungled, creates a direct line of risk straight to the boardroom. The same applies to maintaining statutory registers, filing confirmation statements, or properly recording board decisions. Each failure exposes the directors personally.

Heightened Scrutiny in a New Era of Compliance

The legal landscape is also becoming much stricter, placing an even greater emphasis on diligent record-keeping and corporate transparency. The complexity of these duties has ramped up with new enforcement powers brought in by legislation like the Economic Crime and Corporate Transparency Act. Add to that the 2025 Companies House reforms, which introduced mandatory identity verification for directors and Persons with Significant Control (PSCs).

These changes demand rigorous compliance, making the company secretary role absolutely critical to avoiding legal risks, penalties, or director disqualifications. You can learn more about how the UK corporate register is evolving by exploring the latest government statistics and updates. This heightened focus on accuracy means directors must be more proactive than ever in ensuring their company’s governance is flawless.

Mitigating Your Personal Risk

Understanding these liabilities isn’t about creating fear; it’s about empowering directors to manage risk effectively. The single most effective way to protect yourself is to ensure these critical duties are handled with genuine expertise, whether that’s through a qualified internal appointment or a specialist outsourced provider.

A competent company secretary acts as your first line of defence. They implement robust systems to ensure deadlines are met, records are accurate, and the board is kept fully informed of its obligations. An actionable insight is to request a simple, one-page compliance dashboard from your company secretary each quarter. This report should confirm that all filings are up to date and flag any upcoming deadlines, giving directors clear oversight without getting lost in the details. To help you stay on top of your responsibilities, it’s a great idea to use a detailed UK company compliance checklist as a guide.

By ensuring these tasks are managed professionally, you are not just delegating work—you are actively mitigating your personal legal and financial exposure. This allows you to lead the company with confidence, knowing its foundational governance is secure.

Common Questions About the Company Secretary Role

Navigating the rules around the company secretary role can throw up a lot of practical questions, especially for new business owners. To wrap things up, here are some clear, straightforward answers to the queries we hear most often.

Think of this as a quick-reference guide to help you make smart decisions about your company’s governance and stay on the right side of the law.

Can a Director Also Be the Company Secretary?

Absolutely. For a private limited company, it’s very common for a director to wear both hats. In smaller businesses where everyone juggles multiple responsibilities, this is often the most practical and cost-effective setup.

There’s just one critical exception: if your company only has a single director, that person cannot also be the company secretary. In that scenario, you’ll need to appoint someone else to fill the role. Public limited companies (PLCs) have much stricter rules and always require a separate, qualified individual.

What Qualifications Does a Company Secretary Need?

This really depends on the type of company you’re running. For private limited companies, the law doesn’t actually specify any formal qualifications. The directors just need to be confident that the person they appoint has the skills and experience to do the job properly.

Public companies are a different beast altogether. They face much tougher requirements, and their company secretary must be formally qualified.

For a PLC, a qualified individual is usually a chartered accountant, a solicitor, or someone who holds a recognised qualification from a professional body like The Chartered Governance Institute UK & Ireland (CGI).

Does My Small Limited Company Really Need One?

Legally speaking, no. Private limited companies in the UK are no longer required to appoint a company secretary, so the decision is entirely up to you.

If the directors have the time and feel confident they can handle all the admin—like filing documents with Companies House on time and keeping the official company books in order—then you might not need one when you’re just starting out.

But as your business grows, so does the paperwork. Appointing a secretary, or outsourcing the work, quickly becomes a sensible move. It frees up the directors’ time, slashes the risk of fines for missed deadlines, and lets you get back to focusing on what really matters: growing your business.

At Acorn Business Solutions, we take the headache out of corporate compliance. From forming your company to filing your confirmation statements, we manage the admin so you can build your business. See how we can support you at https://acornbusinesssolutions.com.