Companies House Change Registered Address

Companies House Change Registered Address – To change your registered address, you’ll need to formally notify Companies House, either online or by post. The key rule? Your new location must be a physical UK address where official mail can be received and acknowledged.

This isn’t just a box-ticking exercise anymore. Recent legislation has given Companies House real teeth, allowing them to reject non-compliant addresses and penalise companies that fail to maintain an appropriate one.

Why Your Registered Address Is Now Under Scrutiny

Think of your company’s registered address as more than just a spot for the postman. It’s a fundamental legal requirement, and one that Companies House is now actively policing. Thanks to new UK legislation, their role has shifted from a passive registrar to an active regulator with the power to scrutinise and reject unsuitable addresses.

So what does this mean for you? Your address must be “appropriate”—a genuine physical location where official documents can be reliably delivered and signed for by a real person. A simple PO Box, for example, is no longer going to cut it and will be rejected straight away.

The Consequences of Non-Compliance

The stakes have definitely been raised. Getting this wrong can lead to some pretty serious consequences, from fines to your company being struck off the register entirely.

This increased oversight is all part of a wider government crackdown on the misuse of the company register, aimed at boosting transparency and ensuring the data held is accurate. And it seems businesses have been paying attention.

A recent analysis showed that over 20% of all UK companies—that’s more than a million businesses—changed their registered address in anticipation of these stricter rules. For many, it was a strategic move to make sure they were compliant with the new definition of an “appropriate address.”

Actionable Insight: If you receive a warning letter from Companies House about your address, don’t ignore it. You typically have a 14-day window to rectify the issue. Act immediately by filing an address change to a compliant location to avoid penalties.

These updates are tied to broader efforts to verify company data, making it essential for directors to stay on top of their obligations. To get the full picture on related requirements, check out our guide on why directors must verify their identity. This guide will walk you through everything you need to know for a smooth and compliant address change.

How To Choose a Compliant Registered Address

Before you even think about starting the companies house change registered address process, the first and most crucial job is picking a new, compliant address. This isn’t just about finding a new postcode; your chosen address must be a physical location in the correct UK jurisdiction where official mail can be reliably received and signed for.

Crucially, PO Box numbers are not permitted. Using one is a surefire way to get your application immediately rejected by Companies House. This isn’t just bureaucratic red tape; it’s part of a major push for greater transparency on the UK company register. New legislation has handed Companies House some serious powers to investigate and strike off non-compliant addresses.

Evaluating Your Address Options

So, what are your choices? You’ve generally got four main paths to consider, each with its own benefits and drawbacks.

- Your Home Address: A practical example is a freelance consultant starting out. Using their home address is easy and free, but it means their private address is publicly searchable online, which can be a significant privacy issue.

- Your Business Premises: A retail shop or a small factory can use their trading address. This is a solid, compliant option, but it’s not practical for remote-first or online businesses without a physical footprint.

- Your Accountant’s Office: Many accountancy firms offer this service. It ensures compliance, but you’re dependent on them for mail handling, which might involve delays or extra fees.

- A Virtual Office/Mail Forwarding Service: This offers a professional city-centre address without the high rent, keeping your home address private and ensuring mail is handled professionally. (Read more about our professional registered office service)

To get a better handle on what this involves, have a look at our detailed guide explaining what is a registered office.

Practical Tip: When vetting a virtual office provider, ask them directly: “Can you confirm your service meets the ‘appropriate address’ requirements under the Economic Crime and Corporate Transparency Act 2023?” Their answer will tell you everything you need to know.

These tougher regulations are already making a big difference. In the first six months after the rules changed, Companies House removed an incredible 60,700 registered office addresses that it flagged as inappropriate. You can read more about their mission of improving the quality of data on the company register to see just how seriously they’re taking this.

Changing Your Address Online: The 5-Minute Method

If you need to update your company’s registered address, doing it online is by far the quickest and most secure route. The whole thing is done through the Companies House WebFiling service, it’s completely free, and usually takes just a few minutes. Best of all, the change often appears on the public register within 24 hours.

Before you start, you’ll need two bits of information ready to go: your company number and your authentication code.

Your authentication code is a 6-character alphanumeric code that was posted to your registered address when the company was first set up. Not having this to hand is the number one reason people get stuck, so it’s worth finding it before you log in.

Getting Started with WebFiling

Once you’ve got your details, head over to the Companies House online service. The platform is pretty user-friendly and guides you straight to the digital form you need to change your address.

This is the main Companies House services page on GOV.UK that you’ll be looking for.

From this page, you’ll click into the “Find and update company information” service, log in, and you’re ready to start.

The system will then ask you to type in the new registered address. Take a moment here and double-check every detail. A simple typo in the postcode is a common slip-up that can get your filing rejected, meaning you have to start the whole process again.

Actionable Insight: Always save or print the final submission summary page. For example, take a screenshot of the “Submission Successful” page that shows the date and time. This serves as your immediate proof of filing while you wait for the official confirmation email from Companies House.

After you hit submit, you can keep an eye on the filing’s progress right from your account dashboard. The confirmation email usually lands in your inbox within a few hours, officially letting you know that your address is updated on the public register. That email is your final green light—the process is complete, and your company is fully compliant.

Using Form AD01 for a Postal Address Change

While snapping up the online option is nearly always faster, there are times when you might need—or just prefer—to do things by post. If you’re going the traditional route, Form AD01 is the document you’ll need. This is the official paper form for notifying Companies House of your new registered office address.

Getting this form right the first time is crucial. A simple mistake can get it rejected, sending you right back to square one and causing frustrating delays. You’d be surprised at what trips people up—it’s often a case of mistyping the company number, leaving a field blank, or forgetting to sign it. An unsigned form is an instant rejection.

Completing the Form Correctly

You’ll need to focus on two key sections of the AD01 form:

- Section A: Company Details This is where you put your full company name and, most importantly, the correct company registration number. I can’t stress this enough: double-check this number. Even a single digit out of place will see the form bounced back.

- Section B: New Registered Office Address Write the new address clearly and completely. And remember the golden rule: it has to be a physical UK address in the same part of the UK where your company was originally registered (e.g., a company incorporated in England and Wales must have its registered office in England or Wales).

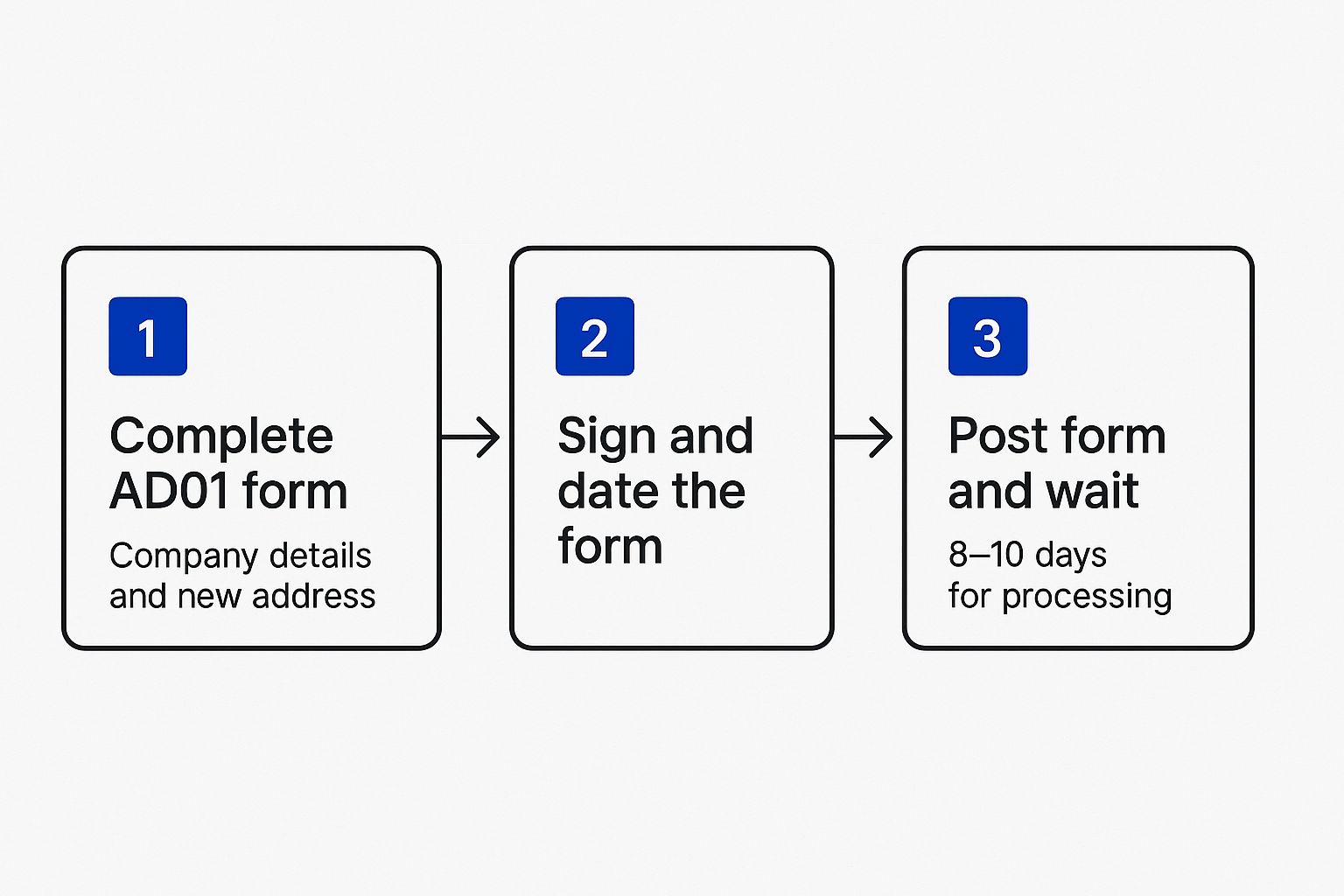

This simple infographic lays out the postal process for you.

Once the form is filled out and signed by a director, company secretary, or another authorised individual, it’s ready to be posted to the main office in Cardiff. This is where the main drawback of postal filing becomes apparent: the waiting game begins.

Practical Example: A director fills out Form AD01 but their signature doesn’t match the one on record, or they forget to date it. Companies House will reject the form and post it back, adding at least another week to the process. To avoid this, use a clear, consistent signature and double-check every box is filled before sealing the envelope.

During this processing limbo, crucial official mail could still be heading to your old address, which is why planning ahead is so important. Using a professional service can provide a stable, long-term address and remove this uncertainty. You can explore the benefits of mailbox rental to see how it can simplify compliance.

Your change is only official once it appears on the public register, so be sure to check the Companies House website regularly after you’ve posted your form.

Your Essential Post-Change Checklist

Getting your companies house change registered address filed and accepted is a big tick off the list, but the job isn’t quite done. Think of it as the first domino. Now you need to make sure everything else falls into place to keep your business compliant and running smoothly.

Skipping this next stage can cause some serious headaches down the line. We’re talking about missed legal notices, delayed payments from clients, and a whole lot of compliance trouble. You’ve got to create a ripple effect, making sure your new address pops up everywhere it’s supposed to.

Who to Tell Straight Away

Your first port of call should be all the government and financial bodies your company deals with. They don’t get an automatic ping from Companies House, so it’s on you to reach out and let them know you’ve moved.

Make this group your top priority:

- HM Revenue & Customs (HMRC): This is a big one. You need to inform them of your new address for Corporation Tax, VAT, and PAYE. It’s absolutely essential for receiving important correspondence and staying on the right side of the taxman.

- Your Business Bank: Get in touch with your bank to update your details. The last thing you want is disruption to your banking, statements going astray, or new debit cards ending up at the old address.

- Insurers: Drop a line to your business insurance providers. Keeping your policies for things like public liability or professional indemnity valid depends on them having your correct details.

Once the official bodies are sorted, turn your attention to your day-to-day contacts. Think about key suppliers, your accountant, and of course, your major clients. Updating them ensures invoices and other communications don’t get lost in the post.

Actionable Insight: Create a simple spreadsheet listing every place your old address is registered (HMRC, bank, suppliers, website, Google Business Profile, etc.). As you update each one, mark it as complete. This turns a daunting task into a manageable checklist and ensures nothing gets missed.

A Quick Word on Director Privacy

Recent reforms have brought in a welcome update for director privacy. If you were using your home address as the company’s registered office, you might now be able to hide it from the public historical record. The Economic Crime and Corporate Transparency Act gives directors the power to apply to have their residential addresses suppressed from past filings.

There’s a catch, though. You must first change your registered office to a proper, non-residential address before you can apply for suppression using Form SR01. It’s a great way to take back a bit of control over your personal data. You can learn more about how these address suppression changes impact company directors and what it means for you.

Common Questions About Changing Your Registered Address

Going through the motions of updating your registered address with Companies House seems straightforward, but there are always a few common sticking points that catch people out. Let’s tackle the questions we hear most often to help you avoid any simple but potentially costly mistakes.

Can I Use a PO Box for My Registered Office?

In a word, no. This is a non-negotiable rule. Your registered office must be a genuine physical address in the UK where official documents can be delivered and signed for.

Companies House will automatically reject any application listing a PO Box. For instance, an address like “PO Box 123, London, SW1A 1AA” will be flagged and rejected immediately. The address has to meet a legal standard of being an “appropriate address,” meaning someone can actually be there to receive important mail.

How Quickly Does the Change Appear Online?

This really comes down to how you file the paperwork.

- Online Filings: If you do it online, it’s usually incredibly fast. You can often see the new address appear on the public register within 24 hours. It’s the quickest and most efficient route by far.

- Postal Filings (Form AD01): Going the old-school paper route is much, much slower. You should brace yourself for a wait of up to two weeks, and sometimes even longer during busy periods.

Practical Tip: If your address change is urgent—for example, you’re finalising a business loan and the bank needs the new address on record—always use the online service. The speed of the online update can be the difference between securing funding and facing delays.

Do I Need to Tell HMRC Separately?

Yes, absolutely. This is a critical step that’s so easy to forget. While you’d think government departments would talk to each other, Companies House and HMRC systems are not linked up for this purpose.

It’s your responsibility to notify HMRC of the address change separately for things like:

- Corporation Tax

- VAT

- PAYE

If you skip this, crucial tax letters and deadlines could be sent to your old address, leading to missed payments and penalties down the line. A quick separate update ensures you stay compliant across the board.

Navigating all these requirements can be a real drain on your time. Acorn Business Solutions offers a suite of services, including Registered Office and mail forwarding, to ensure your company remains compliant with minimal effort. Let us handle the admin so you can focus on your business. Find out more at https://acornbusinesssolutions.com.

Blog Categories

- Startups

- Sales & Marketing

- Leadership

- Finance & Accounting

- Technology & Innovation

- Customer Experience

- Sustainability & Ethics

- Personal Development

- Success Stories

- Legal & Compliance

- Hiring & HR

- Small Business Tips

- E-Commerce

- Networking

- Acorn Insights

- Industry News

Related Topics

Professional Indemnity Insurance

Discover what is professional indemnity insurance, why your business needs it, and how it shields you from costly client claims.

What is a company secretary

Moving home? Learn how do you redirect your mail with Royal Mail or private services. A practical guide to costs, setup,

How Do You Redirect Your Mail in the UK?

Moving home? Learn how do you redirect your mail with Royal Mail or private services. A practical guide to costs, setup,

Top accounting courses for small business in the UK (2025)

Discover accounting courses for small business in the UK. Compare top options, pricing, and formats

UK Business Bank Accounts With No credit Checks

Discover UK business bank accounts with no credit checks. This guide explains your options and eligibility

Managing cash flow for small business: Quick tips

Discover managing cash flow for small business with practical steps to forecast, optimize liquidity,