LTD Company Pros and Cons for UK Businesses

LTD Company Pros and Cons for UK Businesses – Deciding whether to form a limited company often boils down to a single trade-off: you get significant personal asset protection and potential tax perks, but in exchange, you take on greater administrative responsibilities and your business details become public. The limited company structure really comes into its own when your business starts to grow, needs to borrow money, or begins working with larger corporate clients who expect a certain level of professionalism.

Choosing Your UK Business Structure

Picking the right legal framework is one of the most fundamental decisions you’ll make as a UK entrepreneur. The two most well-trodden paths are operating as a sole trader or incorporating a private limited company (LTD). While kicking things off as a sole trader is undoubtedly simpler, forming a limited company creates a distinct legal entity, completely separate from you as an individual. This separation is the very thing that gives rise to its biggest advantages—and its drawbacks.

It’s a distinction that’s becoming more critical for UK businesses. Recent data reveals a telling trend: between March 2024 and March 2025, the number of limited companies in the UK grew by 1.8% to around 2.1 million. In contrast, sole proprietorships saw a 4.1% decrease. You can dig deeper into these UK business demographics over on the Office for National Statistics website.

This guide will break down the essential factors you need to weigh up:

- Liability: How to shield your personal assets (like your house) from business debts.

- Taxation: The potential for smarter, more efficient tax planning.

- Credibility: The way your business is perceived by clients, banks, and investors.

- Compliance: The mandatory admin and paperwork required by law.

Getting your head around these elements is crucial before you commit to the formal duties of running a limited company. One of those key duties is having an official UK-based address, and you can learn more about what is a registered office in our detailed article.

Limited Company vs Sole Trader At a Glance

For a quick overview, the table below highlights the fundamental differences between operating as a limited company and going it alone as a sole trader in the UK.

| Requirement | What It Involves | Typical Deadline |

|---|---|---|

| Annual Accounts | Submitting a detailed financial report of the company’s performance to Companies House. | 9 months after your company’s financial year-end. |

| Confirmation Statement | Confirming that the company’s details (directors, shareholders, registered office) are correct and up to date on the public record. | Annually, within 14 days of your company’s anniversary of incorporation. |

| Company Tax Return (CT600) | Filing a detailed return with HMRC to calculate and report your Corporation Tax liability. | 12 months after your accounting period ends. Note: Corporation Tax payment is usually due earlier. |

| Meticulous Record Keeping | Maintaining organised records of all financial transactions, director decisions, and shareholder meetings. | Ongoing; keep records for at least 6 years from the end of the last company financial year. |

As you can see, the choice impacts everything from your personal risk and tax bill to the amount of paperwork you’ll be handling each year. The “right” answer depends entirely on your business goals, your tolerance for risk, and how much administrative work you’re prepared to take on.

The Upsides: Key Advantages of a Limited Company Structure

When weighing up the pros and cons, the advantages of a limited company often present a powerful argument for leaving sole trader status behind. The biggest draws circle around legal protection, clever tax planning, and professional credibility, each offering real, tangible value as your business finds its feet and starts to grow.

Looking at these benefits in practical terms is the only way to make a decision that’s right for you.

The Shield of Limited Liability

This is, without a doubt, the single most important advantage. Think of it as a legal firewall between your business finances and your personal assets. Because the company is its own separate legal entity, it’s responsible for its own debts.

If the worst happens and the business fails, unable to pay its creditors, your personal belongings—your home, car, and savings—are kept safe.

Let’s put that into a real-world scenario. Say you run a small digital marketing agency and you’ve just landed a huge contract. Things go south, the client disputes the work and sues your company for a sum you simply can’t afford.

- As a Limited Company: The legal claim is against the company’s assets, not yours. Your personal finances are safe, apart from the value of any shares you hold (which is usually just £1).

- As a Sole Trader: There’s no legal difference between you and the business. The claimant could come after your personal assets, including your home, to settle the debt.

That protection brings incredible peace of mind, freeing you up to take calculated business risks without betting the house on the outcome.

A limited company structure treats the business as a distinct legal ‘person.’ This separation means the company can enter into contracts, own assets, and incur debt in its own name, shielding the owners from personal responsibility for its liabilities.

Smarter Tax Planning Opportunities

Another massive pull is tax efficiency. A limited company pays Corporation Tax on its profits, which can be considerably lower than the higher-rate Income Tax bands you’d face as a sole trader. But the real game-changer is the flexibility in how you draw an income.

The go-to strategy for most directors is to blend a small, tax-efficient salary with larger dividend payments.

- Director’s Salary: You can pay yourself a salary up to the National Insurance Primary Threshold (£12,570 for 2024/25). This counts as a deductible business expense, which lowers your Corporation Tax bill, and you won’t pay any Income Tax or employee’s National Insurance on it.

- Dividends: You can then take the rest of your income as dividends, which are paid out from post-tax profits. Dividends aren’t subject to National Insurance and are taxed at much friendlier rates than salary income.

Actionable Insight: A practical example would be a consultant whose company makes a £60,000 profit. As a sole trader, they would pay Income Tax and Class 4 National Insurance on the full amount. As a limited company director, they could take a £12,570 salary (tax-free) and the remaining £47,430 as dividends, resulting in a significantly lower overall tax bill.

This two-pronged approach can lead to a much, much lower personal tax bill compared to a sole trader, who has to pay Income Tax and National Insurance on absolutely all profits.

Enhanced Professional Credibility

Finally, don’t underestimate the power of perception. Operating as a limited company seriously boosts your professional image. That simple ‘LTD’ or ‘Limited’ at the end of your name is a badge of credibility.

It’s not just about looking good, either. Many larger corporations and public sector bodies have strict procurement policies that mean they will only work with incorporated businesses.

This enhanced status can unlock a whole new level of opportunities:

- Winning Bigger Contracts: It signals to potential clients that your business is a stable, professional, and properly managed entity.

- Securing Finance: Banks and lenders tend to see limited companies as less of a risk, which can improve your chances of getting business loans or investment.

- Attracting Talent: It can make your business a more appealing prospect for skilled employees and potential investors looking for a serious operation.

When you combine this professional standing with the critical protections and tax benefits, it’s easy to see why so many UK entrepreneurs view the limited company structure as the logical next step for their growing business.

Navigating the Drawbacks of a Limited Company

While the benefits of going limited are compelling, it’s not a one-way street. A realistic look at the ltd company pros and cons means weighing those perks against some very real downsides: a heavier administrative load, less privacy, and a list of ongoing costs.

For many founders, these are just part of the cost of doing business, a fair trade for limited liability. For others, they can become a serious headache.

Deciding to incorporate is a big step, and the numbers show it’s not always a permanent one. Between April and June 2025, the UK saw 209,798 new companies form, but at the same time, 185,336 were dissolved. That number of dissolutions is up 14.27% from the same period in 2024, a stark reminder that the LTD path isn’t always smooth sailing. You can dig into these trends yourself by exploring the latest government data on UK incorporated companies.

The Weight of Administrative Duties

The first thing you’ll notice after moving from a sole trader setup is the sheer volume of paperwork. This isn’t a small inconvenience; these are legal duties with firm deadlines and the threat of penalties if you miss them.

You’re now on the hook for several key annual filings:

- Annual Accounts: You must prepare and file a set of statutory accounts with Companies House. This is a world away from a sole trader’s tax return and almost always means hiring an accountant.

- Confirmation Statement: Think of this as an annual health check for your company’s records. You’ll need to file it to confirm that the details Companies House holds about your directors, shareholders, and address are still correct.

- Corporation Tax Return (CT600): This is your company’s detailed tax return, which must be submitted to HMRC along with payment for any Corporation Tax you owe.

Actionable Insight: To manage this, set up calendar reminders for your company’s year-end and incorporation anniversary immediately after forming the company. Use cloud accounting software like Xero or FreeAgent from day one to keep records organised, which will save your accountant time (and you money) at year-end.

Getting these right requires diligent record-keeping all year round. Every single expense needs tracking, and major decisions made by directors or shareholders must be properly documented.

A Loss of Financial Privacy

Here’s a drawback that catches many by surprise: your company’s business becomes public business. Unlike a sole trader, where finances are private, key information about your limited company is published on the public register at Companies House. Anyone can look it up.

This public information includes:

- The full names and correspondence addresses of every director.

- Your company’s registered office address.

- Abbreviated financial accounts that give a snapshot of your company’s financial position.

This level of transparency can be a bit jarring for owners who are used to keeping their business affairs to themselves. It means competitors, customers, and even curious neighbours can get a glimpse into how your business is performing.

For a director, incorporating means accepting that your name, address, and an overview of your company’s financial standing become public information. This trade-off between liability protection and personal privacy is a core consideration.

Ongoing Costs and Financial Outlay

Running a limited company also brings a new set of unavoidable costs you simply don’t have as a sole trader. These need to be factored into your business plan from day one.

The initial company formation fee is just the start. You’ll also need to budget for:

- Accountancy Fees: This is usually the biggest ongoing expense. Getting professional help for your annual accounts and tax returns is all but essential, and fees can range from several hundred to well over a thousand pounds a year.

- Confirmation Statement Fee: A small but mandatory annual fee paid to Companies House.

- Business Software: You’ll likely need more sophisticated accounting software to properly manage company finances, track dividends, and handle payroll.

Let’s put it into context. Imagine a freelance graphic designer working part-time from home, bringing in a few thousand pounds a year. The annual cost of an accountant, plus the time spent on formal filings and managing a separate business bank account, could easily eat up a huge chunk of their profits. In that scenario, staying as a sole trader makes far more sense.

Understanding Your Financial and Legal Obligations

Becoming the director of a limited company brings a whole new level of financial and legal responsibility. This isn’t just theory anymore; recent changes from the UK government have brought in real costs and much stricter rules that affect every single director. The decision to incorporate is now a serious commitment, one that demands your full attention from day one.

A major catalyst for this shift is the Economic Crime and Corporate Transparency Act (ECCT). This new law gives Companies House significant new powers to investigate company information and requires stricter identity checks for all directors. While the aim is to boost transparency and tackle fraud, for genuine business owners, it simply means more hurdles to clear and a higher bar for compliance.

The Real-World Impact of New Regulations

These regulatory changes aren’t just about extra paperwork; they come with a direct financial sting. For the financial year ending 2025, company incorporations dropped by a notable 10% after Companies House hiked the setup fee from a modest £12 to £50 in May 2024. In the same period, company dissolutions soared to a record high of 726,735, an increase of 9.6%. You can see more data on how these changes have impacted UK company formations in Uniwide’s 2025 review.

This trend paints a very clear picture: rising costs and tighter regulations are forcing business owners to think twice.

The connection is undeniable: as the cost and complexity of running a limited company go up, so does the rate at which businesses decide the structure just isn’t worth it. This really hammers home the need to realistically assess the ongoing duties before you take the plunge.

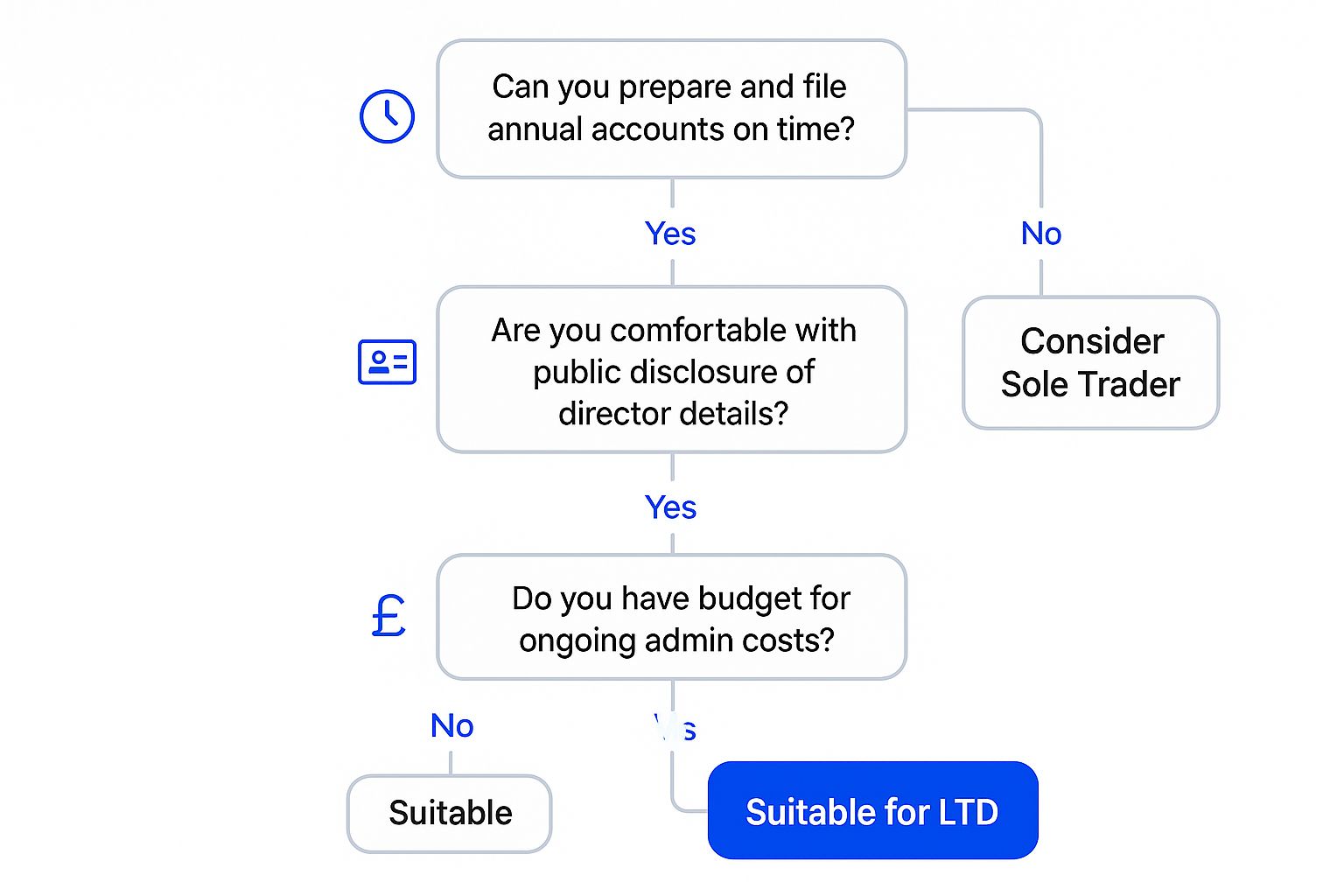

This simple decision tree can help you quickly gauge if you’re truly ready for the core responsibilities that come with a limited company.

As the infographic shows, a ‘No’ at any point—whether it’s about managing accounts, being comfortable with public disclosure, or affording the admin—strongly suggests that the sole trader path might be a better fit for you.

Your Core Duties as a Director

Being a company director isn’t just a fancy title; it’s a role with specific, legally binding duties. You are personally on the hook for making sure the company follows the law, even if you pay an accountant to handle the filings for you. For a deeper dive into what this involves, you can learn more about the tax implications of forming a UK limited company in our detailed guide.

At a minimum, you’ll need to stay on top of several key annual tasks.

Limited Company vs Sole Trader At a Glance

For a quick overview, the table below highlights the fundamental differences between operating as a limited company and going it alone as a sole trader in the UK.

| Feature | Limited Company | Sole Trader |

|---|---|---|

| Legal Status | A separate legal entity from its owners. | The owner and the business are the same legal entity. |

| Liability | Limited liability – personal assets are protected. | Unlimited liability – personal assets are at risk. |

| Taxation | Pays Corporation Tax on profits. | Pays Income Tax and National Insurance on profits. |

| Credibility | Generally higher professional image and trust. | Often perceived as smaller or less established. |

| Admin Burden | Higher (annual accounts, confirmation statement). | Lower (annual Self Assessment tax return). |

| Privacy | Director and company details are public. | Financial details and ownership are private. |

As you can see, the choice impacts everything from your personal risk and tax bill to the amount of paperwork you’ll be handling each year. The “right” answer depends entirely on your business goals, your tolerance for risk, and how much administrative work you’re prepared to take on.

When to Choose a Limited Company Structure

Knowing the textbook pros and cons of a limited company is one thing, but figuring out if it’s the right move for you is another beast entirely. The best way to cut through the theory is to look at how the structure plays out in the real world.

Let’s walk through three common business scenarios. See which one feels most familiar, and you’ll get a much clearer idea of whether you should be thinking about incorporating.

Scenario One: The Growing Agency Billing Corporate Clients

Picture this: you’ve built a successful digital marketing agency from the ground up. You started out as a freelancer, but now you’ve got a small team and are starting to land contracts with much larger, corporate businesses. These companies have strict procurement processes and expect a certain level of professionalism from their suppliers.

In this situation, operating as a limited company becomes almost essential. That limited liability is your safety net, protecting your personal finances as you take on bigger, higher-value projects. More than that, the ‘LTD’ after your name gives you the credibility you need to even get past the gatekeepers in corporate procurement departments.

For any business aiming to secure large B2B contracts, the limited company structure is a strategic asset. It signals stability and professionalism, ticking a major box in the risk assessment criteria of bigger clients.

- Actionable Insight: If your growth plan involves targeting enterprise-level clients or bidding for public sector work, you should prioritise incorporating. Many of these organisations have policies that simply won’t allow them to work with sole traders.

- Verdict: Choose a Limited Company. The combination of liability protection and professional credibility is vital for winning bigger contracts and growing in this market.

Scenario Two: The Part-Time Artisan Seller

Now, let’s switch gears. Imagine a skilled artisan who makes and sells handcrafted jewellery on Etsy. It’s a passion project that brings in a nice bit of supplemental income. They manage everything themselves, from making the products to shipping them out, and have very few business expenses.

For this kind of entrepreneur, the admin and ongoing costs of running a limited company would likely be more hassle than they’re worth. The simplicity of being a sole trader is a much better fit. Filing a single Self Assessment tax return each year is far less complex than juggling annual accounts, confirmation statements, and Corporation Tax returns.

- Actionable Insight: If your business is more of a side hustle with low turnover and minimal financial risk, the sole trader route keeps things simple and cheap. You can always choose to incorporate later if the business really takes off.

- Verdict: Stick with a Sole Trader. The low overheads and minimal paperwork are perfectly suited to a small-scale, part-time venture.

Scenario Three: The Tech Startup Seeking Investment

Finally, let’s look at a tech startup with a groundbreaking software idea. The founders have a clear plan for rapid growth, but they need a significant injection of cash to hire developers, market the product, and get the business off the ground. Their entire strategy depends on bringing in angel investors or venture capitalists.

This is a clear-cut case for incorporating. The ability to issue shares is the only way to sell equity to investors. A sole trader structure just doesn’t allow for this. Investors need a formal, legally recognised ownership stake, which they can only get through shares in a limited company.

- Actionable Insight: If your business model relies on raising equity investment at any point, forming a limited company is non-negotiable. It’s the only UK business structure that makes this kind of funding possible.

- Verdict: Choose a Limited Company. It is an absolute must-have for securing investment and scaling your business through shared ownership.

A Few Final Questions

Even when you’ve weighed up all the pros and cons, a few lingering questions often pop up just as you’re about to take the leap. Getting these final points sorted can give you the confidence you need to move forward.

Here are the straightforward answers to some of the most common questions we hear about running a limited company in the UK.

Can I Run a Limited Company By Myself?

Yes, absolutely. A private limited company can be set up and run by just one person, who acts as both the sole director and sole shareholder. This is an incredibly common setup for consultants, contractors, freelancers, and small business owners all over the country.

Of course, even though you don’t need a business partner, you’re still legally on the hook. You’ll have to fulfil all the statutory director duties and hit every filing deadline with both Companies House and HMRC.

What Are the Typical Annual Costs?

Costs can vary quite a bit depending on your specific business, but there are a few core expenses you’ll need to budget for. You’ll have the annual confirmation statement fee for Companies House, business insurance, and maybe some fees for your business bank account.

The most significant ongoing cost, however, is usually your accountant. Depending on your company’s turnover and how complex your transactions are, their fees to prepare and file your annual accounts and Corporation Tax return can be anywhere from several hundred to over a thousand pounds a year.

Realistically budgeting for professional accountancy fees is one of the most important parts of weighing up the pros and cons. Forgetting this cost can give you a skewed view of your potential profitability.

How Do Director Salaries and Dividends Differ?

Understanding this is absolutely crucial for tax efficiency. A director’s salary is treated as an allowable business expense, which is great because it reduces your company’s taxable profit before Corporation Tax is calculated. The catch is that this salary is subject to both employee and employer National Insurance Contributions (NICs).

Dividends, on the other hand, are payments made to shareholders out of the company’s after-tax profits. The real advantage here is that dividends aren’t subject to NICs and come with their own tax-free allowance and lower tax rates. For a deeper dive into your company’s main tax obligations, check out our comprehensive guide to Corporation Tax.

This strategic mix of a low salary and higher dividends is often the most tax-efficient way for directors to take money out of their company.

Navigating the complexities of company formation and compliance is where Acorn Business Solutions can help. We provide a full suite of services, from company registration and virtual office addresses to ongoing compliance management, allowing you to focus on what you do best—growing your business. Start your journey with confidence at https://acornbusinesssolutions.com.

Blog Categories

- Startups

- Sales & Marketing

- Leadership

- Finance & Accounting

- Technology & Innovation

- Customer Experience

- Sustainability & Ethics

- Personal Development

- Success Stories

- Legal & Compliance

- Hiring & HR

- Small Business Tips

- E-Commerce

- Networking

- Acorn Insights

- Industry News

Related Topics

Professional Indemnity Insurance

Discover what is professional indemnity insurance, why your business needs it, and how it shields you from costly client claims.

What is a company secretary

Moving home? Learn how do you redirect your mail with Royal Mail or private services. A practical guide to costs, setup,

How Do You Redirect Your Mail in the UK?

Moving home? Learn how do you redirect your mail with Royal Mail or private services. A practical guide to costs, setup,

Top accounting courses for small business in the UK (2025)

Discover accounting courses for small business in the UK. Compare top options, pricing, and formats

UK Business Bank Accounts With No credit Checks

Discover UK business bank accounts with no credit checks. This guide explains your options and eligibility

Managing cash flow for small business: Quick tips

Discover managing cash flow for small business with practical steps to forecast, optimize liquidity,