What Is a Memorandum and Articles of Association

What Is a Memorandum and Articles of Association – When you set up a UK limited company, you’ll come across two critical documents: the memorandum of association and the articles of association. While they sound similar and are filed together, they serve very different purposes.

Think of the memorandum as a historical snapshot—a one-time declaration by the first shareholders to form the company. In contrast, the articles of association are the company’s living rulebook, detailing how it must be run day-to-day.

Your Company’s Constitutional DNA

Forming a limited company means creating a brand new legal entity, entirely separate from yourself. Just like a country has a constitution, your company needs its own set of governing documents to function correctly. This is exactly what the memorandum and articles of association provide—they are the legal bedrock for your business.

Although they’re submitted to Companies House at the same time during incorporation, their roles couldn’t be more different. Getting your head around this distinction is vital for any director or shareholder, as it affects everything from day-to-day decisions to long-term control of the business.

The Two Pillars of Company Governance

Put simply, one document signals the intent to create the company, while the other defines how it will actually live and breathe.

- Memorandum of Association: This is a short, standard-form document. It simply states that the initial subscribers (the very first shareholders) want to form a company under the Companies Act 2006 and agree to take at least one share each.

- Articles of Association: This is where the real detail is. It’s a much more substantial document that lays down the internal rules for running the company. This includes everything from the powers of the directors and the rights of shareholders to the procedures for holding meetings and voting.

Practical Example: Think of it like building a house. The Memorandum is the official record of laying the foundation stone—a crucial event, but one that happens only once. The Articles are the architectural blueprints that dictate how every room, window, and doorway will function for the entire life of the building, including rules on who can make changes to the layout.

For any company formed after 1st October 2009, the memorandum is a prescribed, unchangeable document. The real focus for founders and directors, therefore, should always be on the articles. This is the operational manual you’ll refer back to time and time again.

Memorandum vs Articles of Association At a Glance

To make it even clearer, this table highlights the fundamental differences between the memorandum and articles of association.

| Aspect | Memorandum of Association | Articles of Association |

|---|---|---|

| Primary Function | A historical record of the founders’ intent to form a company. | The current rulebook for the company’s internal management and governance. |

| Typical Content | Names of the initial subscribers and their agreement to form a company. | Director powers, shareholder rights, meeting protocols, and share transfer rules. |

| Flexibility | Cannot be changed after incorporation. | A living document that can be amended by a special resolution of the shareholders. |

As you can see, the memorandum is set in stone, while the articles are designed to be flexible and evolve with the company. This adaptability is crucial for handling future growth, new investors, or changes in business strategy.

The Memorandum of Association: A Historical Snapshot

When getting to grips with a company’s constitutional documents, most founders understandably focus on the articles. That makes perfect sense. For any UK company set up after 1st October 2009, the memorandum of association is really just a historical snapshot—a simple, formal statement of intent from the very first members.

Think of it as the moment the founders publicly declared, “We want to form a company.” Its role was massively simplified by the Companies Act 2006, which turned it from a complex rulebook into a straightforward record. This one-page document is submitted during company formation and, crucially, it can never be changed or updated.

Because it’s set in stone, it forever captures the names of the initial subscribers (the original shareholders or guarantors) and their agreement to form the business and take at least one share each. It’s a permanent, public record of who was there at the very beginning.

What the Memorandum Actually Says

For companies limited by shares, the modern memorandum uses standard, prescribed wording. You don’t need to draft it from scratch; it’s a simple declaration that’s automatically generated when you incorporate your company.

Here’s the exact text you’ll find:

“Each subscriber to this memorandum of association wishes to form a company under the Companies Act 2006 and agrees to become a member of the company and to take at least one share.”

Beneath this statement, the subscribers’ names are listed, confirming their commitment. And that’s it. No complex legal jargon, no operational rules to get lost in. Its purpose is singular: to confirm the founders’ initial intention to get the ball rolling. This simplicity is a deliberate and very helpful feature of modern UK company law.

The Old ‘Objects Clause’ – A Relic of the Past

Before the Companies Act 2006 kicked in, the memorandum was a much more beastly document. It used to contain a critical section known as the ‘objects clause’, which spelled out the specific activities the company was allowed to do.

This old requirement was a legal minefield. If a company acted outside the scope of its stated objects (an act known as ultra vires), the transaction could be ruled invalid. Founders had to pay lawyers to draft ridiculously long and complicated objects clauses, trying to predict every single business activity their company might ever dream of doing.

Actionable Insight: The move away from a restrictive ‘objects clause’ gives modern businesses incredible flexibility. It means a tech company can pivot to consulting, or a retail business can branch into manufacturing, without needing complex legal changes. This agility is a key advantage of the current system.

Recognising what a headache this was, the 2006 Act completely streamlined the process. For companies formed from 1st October 2009, the memorandum became a short incorporation record, and the company’s objects were moved into the articles instead. Now, by default, a new company has unrestricted objects unless it specifically chooses to limit them, removing a common legal trap and cutting down on bespoke drafting costs. You can read more about how the model articles work on the UK government’s website.

This change means today’s entrepreneurs can get started faster and with far more flexibility, safe in the knowledge their company isn’t shackled by outdated, rigid rules. The memorandum is now just a simple, unchangeable historical document, leaving founders to focus on the far more important and adaptable rulebook: the articles of association.

The Articles of Association: Your Company’s Rulebook

If the memorandum of association is your company’s birth certificate, then the articles of association are its living, breathing rulebook. This is the document that truly matters for the day-to-day running and long-term direction of your business. It’s the set of rules that everyone—from directors to shareholders—has to follow.

Think of it as the constitution for your company. It lays out all the internal regulations on how your business is managed, dictating everything from who holds power to how critical decisions get made. Without clear articles, a company would be flying blind, leaving it wide open to disputes, power struggles, and operational chaos.

This is where the real substance of your company’s governance lies. It’s a dynamic set of regulations that can, and often must, be updated as your business grows and its needs evolve.

What Goes Inside the Articles?

The articles of association cover a huge range of essential topics that form the backbone of your company’s internal administration. While the specifics can vary from business to business, most articles will address a core set of rules.

Key areas you’ll typically find defined within the articles include:

- Directors’ Powers and Responsibilities: This section outlines what directors are allowed to do on behalf of the company. It covers their authority to enter into contracts, borrow money, and manage the daily operations.

- Shareholder Rights and Voting: It specifies the rights attached to different types of shares, how shareholder meetings are called and run, and the exact procedures for voting on company resolutions.

- Issuing and Transferring Shares: The articles set the rules for how new shares can be created and offered. They also detail any restrictions on selling or transferring existing shares to other people.

- Distribution of Profits: This part explains how and when the company can distribute its profits to shareholders, usually in the form of dividends.

- Appointment and Removal of Directors: It establishes the process for appointing new directors to the board and, just as importantly, the procedures for removing them if necessary.

Essentially, the articles provide a clear framework for every major procedural aspect of your company. This is why getting your head around what is a memorandum and articles of association is so critical; the articles are your guide to compliant and effective management.

The Real-World Impact of Your Articles

Imagine two co-founders disagree on a massive business decision, like taking on a large loan. Without clear rules in the articles about director decision-making or voting thresholds, they could easily find themselves in a stalemate, paralysing the company.

Practical Example: The articles can prevent this by setting out predefined procedures. For instance, they might state that decisions require a majority vote at a board meeting, or that certain major financial commitments (like a loan over £50,000) need unanimous director approval or a 75% shareholder majority. This structure ensures decisions are made fairly and consistently, keeping the business moving.

For modern UK private companies, especially startups and SMEs, the articles of association are now the central constitutional document. The UK government provides model articles under the Companies Act 2006, which act as the default constitution if you don’t file your own bespoke articles when you incorporate. Different versions apply to the three main company types, so founders must choose the correct set. You can find more details in the UK government’s guidance on company structures and legal frameworks.

The articles are your first line of defence against internal disputes and your roadmap for growth. They provide the clarity needed to navigate complex situations, from bringing in a new investor to resolving conflicts between shareholders. This document also influences how outsiders see you. Banks, investors, and potential business partners will often want to review a company’s articles to understand its governance structure before they commit to anything. Well-drafted articles signal a well-organised and professional operation. A good grasp of the articles can also support those with specific roles, which is why our guide on the duties and responsibilities of a UK company secretary might be a useful next read.

So, while the memorandum marks the start of your company’s journey, it’s the articles of association that provide the detailed map and rules of the road for the entire adventure ahead.

Choosing Between Model and Bespoke Articles

When you incorporate your UK limited company, you’ll hit a crucial fork in the road. Should you stick with the government’s default ‘model articles’, or is it worth investing in a set of ‘bespoke articles’? This isn’t a minor detail; it’s a decision that shapes how your company is run, so it’s not one to take lightly. Getting your head around the pros and cons of each is vital for building a legal foundation that serves your business both now and down the line.

The off-the-shelf option from Companies House is what’s known as the model articles. For a huge number of new businesses, especially those with a straightforward setup, these are a perfect fit. They are free, instantly available, and fully compliant with the Companies Act 2006, giving you a simple and cost-effective way to get up and running without any drama.

When Model Articles Are the Smart Choice

For many startups and small businesses, the model articles are more than enough. They provide a solid, well-understood rulebook for running your company that covers all the essentials.

You should seriously consider using the model articles if your company:

- Has a single director and shareholder. If you’re the sole owner and operator, the simplicity of the model articles is your best friend.

- Has a small group of shareholders with equal rights. When everyone holds the same class of shares and has identical voting rights, the default rules work perfectly.

- Isn’t looking for immediate external investment. The model articles are not built to handle the complex demands of venture capitalists or angel investors.

- Runs a straightforward business. If your day-to-day operations are pretty standard, there’s little reason to overcomplicate your governance with custom rules.

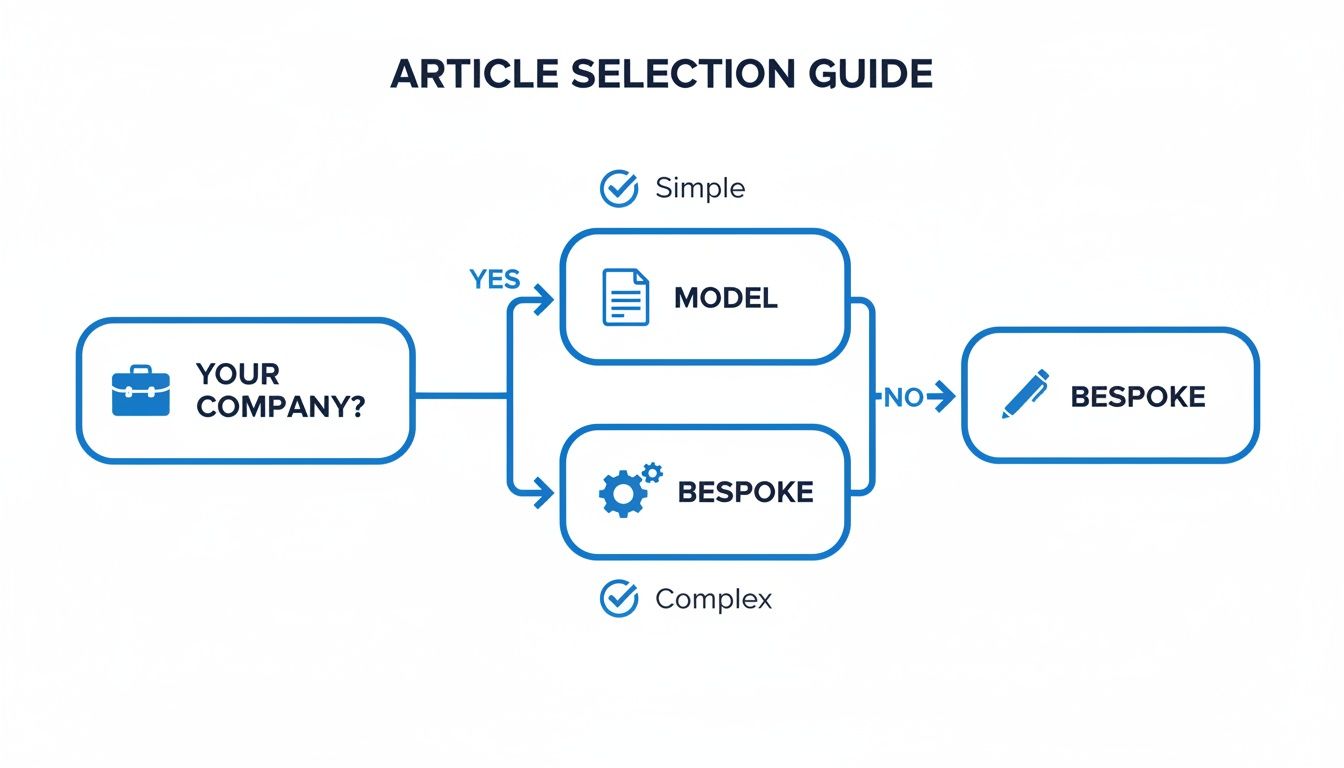

This visual decision tree can help you figure out quickly if model articles are right for your simple structure or if your plans call for something more tailored.

As the flowchart shows, the right path really depends on your company’s complexity and where you plan to take it.

Scenarios Demanding Bespoke Articles

Once your business starts to grow, or if it has a more complex structure from day one, the limitations of the model articles can become a real headache. In these cases, drafting bespoke articles isn’t just a nice-to-have—it’s a necessity. These are custom-written rules, tailored precisely to your company’s unique DNA.

Actionable Insight: Creating bespoke articles is about future-proofing your business. It allows you to build a governance framework that anticipates challenges and opportunities, from investor negotiations to shareholder disagreements, before they happen.

Bespoke articles become essential in several common situations. For instance, if you want to issue different classes of shares—maybe to give some shareholders stronger voting rights or priority dividends—the model articles just won’t cut it. They only allow for one single class of ordinary shares.

Likewise, if you’re raising capital, investors will almost certainly insist on adding specific clauses to the articles to protect their investment. This could include drag-along and tag-along rights (which dictate how shares are sold if the company is bought) or anti-dilution provisions.

Practical Example: A tech startup with two founders (60/40 split) and an early angel investor needs bespoke articles. They create ‘A’ shares for the founders with full voting rights and ‘B’ shares for the investor that are non-voting but have a ‘1.5x preference’ on dividends. This structure, impossible under model articles, protects the investor’s return while allowing the founders to retain day-to-day control, making the investment deal possible.

Choosing the right articles is a critical first step. The table below breaks down the key differences to help you decide.

Choosing Your Articles: Model vs Bespoke

| Feature | Model Articles | Bespoke Articles |

|---|---|---|

| Cost | Free (included in formation) | Requires professional drafting (£££-££££) |

| Complexity | Simple and standardised | Can be highly complex and customised |

| Share Classes | Only one class of ordinary shares | Multiple share classes with different rights |

| Investor Readiness | Not suitable for external investment | Essential for VC/angel investment deals |

| Director Powers | Standard powers and limitations | Powers can be specifically defined or restricted |

| Best For | Sole traders, simple partnerships, lifestyle businesses | Startups seeking investment, JVs, complex structures |

Ultimately, the choice between model and bespoke articles boils down to an honest assessment of your business’s current reality and future ambitions. While model articles are a fantastic launchpad for simple companies, bespoke articles provide the flexibility and protection needed for more complex ventures. They ensure your company’s rulebook truly reflects how you plan to run your business.

How to File and Change Your Articles of Association

When you first form your company, filing the articles of association with Companies House is a fairly straightforward step. But as your business grows and your goals shift, that initial rulebook might start to feel a bit restrictive. This is where knowing how to amend your articles becomes a vital strategic tool, not just a bit of legal admin.

Think of your articles as a living document. Unlike the memorandum of association, which is locked in place from day one, your articles are designed to evolve with you. UK company law sets out a clear process for making changes, ensuring any modifications are done transparently and with the right authority. It’s a safeguard that protects everyone involved from sudden, unilateral decisions.

The Special Resolution Requirement

So, how do you actually change your company’s rulebook? The key is to pass what’s known as a special resolution. This isn’t your average majority vote; it’s a much higher bar that demands strong consensus from your company’s members (the shareholders).

A special resolution needs the green light from at least 75% of the votes cast by shareholders at a general meeting. This high threshold is there for a good reason. It makes sure that any fundamental changes to the company’s internal rules have the overwhelming support of its owners, preventing a slim majority from pushing through changes that could harm minority shareholders.

The Step-by-Step Amendment Process

Getting that vote is just one part of a formal, structured procedure. You have to follow the process to the letter to make sure everything is above board.

Here’s what you need to do:

- Draft the Proposed Changes: Get everything in writing first. You need to be crystal clear about what you want to change – whether you’re adding a new clause, deleting an old one, or replacing the entire document with a new bespoke set.

- Call a General Meeting: Next, you have to give all shareholders proper notice of a general meeting. Crucially, this notice must include the full text of the special resolution you’re proposing. No surprises – everyone needs to know exactly what’s on the table.

- Hold the Meeting and Vote: At the meeting itself, the special resolution is put to a vote. To get it over the line, you must secure that critical 75% approval from the shareholders who are voting.

Practical Example: A tech startup needs to bring in a major new investor. The investor is demanding a new class of shares with special dividend rights, but the company’s current model articles don’t allow for this. The directors would have to draft new articles, call a general meeting for existing shareholders, and get a 75% vote in favour of adopting the new rules before the investment can go ahead.

Filing the Changes with Companies House

Once the special resolution has been passed, you’re not quite done. The law requires you to notify Companies House of what’s happened.

You have 15 days from the date of the vote to send a copy of the special resolution to Companies House. You also need to file a copy of the newly updated articles of association. This keeps the public record accurate and gives investors, lenders, and partners a clear view of your company’s current governance.

Keeping these documents up to date is a core part of your annual compliance, just like filing your Companies House confirmation statement. Missing the filing deadline can result in penalties, so it’s one you really can’t afford to ignore. This final step is what makes the changes official and legally binding.

For businesses looking to make the management of these foundational documents easier, using legal document automation software can be a huge help in ensuring everything stays accurate and compliant.

Essential Checklist for UK Company Founders

Turning a great idea into a fully-fledged UK limited company involves a few critical legal steps. Getting your head around what a memorandum and articles of association are is the first hurdle. The next is taking action.

This checklist breaks down the practical steps to make sure your company’s constitutional documents are handled correctly from day one. Think of it as your guide to building a solid legal foundation—because the decisions you make now will have a real impact on your company’s future flexibility and growth.

Pre-Incorporation Decisions

Before you even think about registering your company, there are some fundamental choices to make about your articles of association. These early decisions shape your company’s internal rulebook.

- Assess Your Business Structure: Is it just you, or are there partners involved? If you have multiple shareholders, are their stakes and rights going to be identical? The complexity of your structure dictates the complexity of your articles.

- Evaluate Model vs Bespoke Articles: For straightforward setups, like a single director who is also the sole shareholder, the government’s free model articles are usually fine. But if you’re planning for investment, have different classes of shares, or need specific director powers, bespoke articles are a must.

- Consider Future Funding: Are you hoping to attract angel investors or venture capital down the line? They will almost certainly insist on bespoke articles with clauses that protect their investment. Planning for this now can save a lot of time and legal fees later.

During Incorporation

As you move through the company formation process, accuracy is key. Getting these documents prepared and filed correctly will save you from major administrative headaches.

Actionable Insight: Your articles of association are not just a legal formality; they are the operational blueprint for your company’s governance. A small amount of foresight here prevents significant disputes down the line. For example, include a ‘deadlock’ clause that specifies a mediation process if directors can’t agree, preventing the business from grinding to a halt.

- Confirm Director Powers: Double-check what the articles say about the powers granted to directors. Do they have the authority to borrow money, issue new shares, or make key decisions without needing a shareholder vote?

- Clarify Shareholder Rights: Make sure the articles clearly define voting rights, how dividends are paid, and any restrictions on transferring shares. This kind of transparency is vital for keeping relationships between shareholders on solid ground.

Post-Incorporation Management

Once your company is up and running, your articles remain a crucial document. As your business grows and changes, they might need to change too.

- Understand the Amendment Process: Get familiar with how to change your articles. It requires a special resolution, which means you need a 75% majority vote from shareholders. Knowing this procedure is essential for when you need to adapt.

- Maintain Compliance: Always keep a digital and a physical copy of your articles somewhere accessible. For a full picture of your ongoing duties, our company compliance checklist for UK businesses offers more actionable steps. As a company grows, founders also need to think about future logistics; learn more about planning for an office relocation.

Frequently Asked Questions

Getting your head around the legal documents for a new business can throw up some tricky questions. Finding clear answers is the key to starting your company on solid legal ground and dodging the common traps many founders fall into.

Can I Write My Own Articles of Association?

Technically, yes, but it’s an incredibly risky move if you’re not an expert in UK corporate law. Think of it like trying to do your own dental work – you know the outcome you want, but a tiny slip-up can lead to painful and expensive problems down the line.

Practical Example: A founder writes their own articles and includes a clause allowing them to issue new shares at will. When they seek investment, a potential investor pulls out because this clause could be used to dilute their shareholding value without their consent. Using professionally drafted articles would have included standard pre-emption rights, preventing this issue.

A simple drafting error could create rules that are legally useless, leave minority shareholders exposed, or cause huge headaches when you try to bring investors on board. For most new companies, there are two far safer and more sensible options:

- Use the Model Articles: The government’s default articles are free, fully compliant, and work perfectly well for straightforward company structures.

- Get Professional Help: If your needs are more complex, hiring a professional to draft bespoke articles ensures they’re legally sound and perfectly matched to your business goals.

What Happens If I Don’t File Articles of Association?

You actually can’t register a UK limited company without them. The articles are a non-negotiable legal requirement for incorporation. If you go through the company formation process but don’t upload a bespoke set of articles, you won’t be left in a legal black hole.

Instead, Companies House will automatically apply the relevant model articles to your company by default. This system ensures every single registered company has a compliant rulebook from day one. So, you’ll always have articles; the only question is whether they’re the standard off-the-shelf version or a set you’ve customised yourself.

Actionable Insight: Think of the articles as a core part of your company’s DNA. Failing to provide your own simply means you’re accepting the standard legal framework, which may or may not be the best fit for your specific vision. This is fine for a simple business, but can cause problems later if you need specific rules for share transfers or director appointments.

Do Banks Need My Articles to Open an Account?

Yes, almost always. This is a completely standard part of opening a business bank account. Financial institutions are legally required to verify the identity and legitimacy of the companies they work with – a process you’ll often hear called ‘Know Your Customer’ (KYC).

When you apply for an account, the bank will definitely ask for your key constitutional documents. Typically, they’ll want to see your Certificate of Incorporation and a copy of your Articles of Association.

These documents serve two critical purposes for the bank:

- To verify the company’s legal existence: They prove your company is properly registered and legally formed.

- To confirm who’s in charge: The articles spell out the directors’ powers, showing the bank that the people opening the account are actually authorised to manage the company’s money.

Starting your company with the right legal foundation is crucial for long-term success. At Acorn Business Solutions, we simplify the entire company formation process, ensuring your business is set up correctly and compliantly from day one, so you can focus on what you do best.